32 minutes

Written: 2020-02-17 15:28 +0000

ISLR :: Classification

Chapter IV - Classification

All the questions are as per the ISL seventh printing of the First edition 1.

Common Stuff

Here I’ll load things I will be using throughout, mostly libraries.

1libsUsed<-c("dplyr","ggplot2","tidyverse","ISLR","caret")

2invisible(lapply(libsUsed, library, character.only = TRUE))

Question 4.10 - Page 171

This question should be answered using the Weekly data set, which is

part of the ISLR package. This data is similar in nature to the Smarket

data from this chapter’s lab, except that it contains 1, 089 weekly

returns for 21 years, from the beginning of 1990 to the end of 2010.

(a) Produce some numerical and graphical summaries of the Weekly data. Do there appear to be any patterns?

(b) Use the full data set to perform a logistic regression with

Direction as the response and the five lag variables plus Volume as

predictors. Use the summary function to print the results. Do any of the

predictors appear to be statistically significant? If so, which ones?

(c) Compute the confusion matrix and overall fraction of correct predictions. Explain what the confusion matrix is telling you about the types of mistakes made by logistic regression.

(d) Now fit the logistic regression model using a training data period

from 1990 to 2008, with Lag2 as the only predictor. Compute the

confusion matrix and the overall fraction of correct predictions for the

held out data (that is, the data from 2009 and 2010).

(e) Repeat (d) using LDA.

(f) Repeat (d) using QDA.

(g) Repeat (d) using KNN with \(K = 1\).

(h) Which of these methods appears to provide the best results on this data?

(i) Experiment with different combinations of predictors, including possible transformations and interactions, for each of the methods. Report the variables, method, and associated confusion matrix that appears to provide the best results on the held out data. Note that you should also experiment with values for K in the KNN classifier.

Answer

We will need the data in a variable for ease of use.

1weeklyDat<-ISLR::Weekly

a) Summary Statistics

Text

Most of this segment relies heavily on usage of dplyr and especially

the %>% or pipe operator for readability. The use of the skimr

package2 might added more descriptive statistics, but is not

covered here.

Basic Summaries

1weeklyDat %>% str

1# 'data.frame': 1089 obs. of 9 variables:

2# $ Year : num 1990 1990 1990 1990 1990 1990 1990 1990 1990 1990 ...

3# $ Lag1 : num 0.816 -0.27 -2.576 3.514 0.712 ...

4# $ Lag2 : num 1.572 0.816 -0.27 -2.576 3.514 ...

5# $ Lag3 : num -3.936 1.572 0.816 -0.27 -2.576 ...

6# $ Lag4 : num -0.229 -3.936 1.572 0.816 -0.27 ...

7# $ Lag5 : num -3.484 -0.229 -3.936 1.572 0.816 ...

8# $ Volume : num 0.155 0.149 0.16 0.162 0.154 ...

9# $ Today : num -0.27 -2.576 3.514 0.712 1.178 ...

10# $ Direction: Factor w/ 2 levels "Down","Up": 1 1 2 2 2 1 2 2 2 1 ...

We see that there is only one Factor, which makes sense.

1weeklyDat %>% summary

1# Year Lag1 Lag2 Lag3

2# Min. :1990 Min. :-18.1950 Min. :-18.1950 Min. :-18.1950

3# 1st Qu.:1995 1st Qu.: -1.1540 1st Qu.: -1.1540 1st Qu.: -1.1580

4# Median :2000 Median : 0.2410 Median : 0.2410 Median : 0.2410

5# Mean :2000 Mean : 0.1506 Mean : 0.1511 Mean : 0.1472

6# 3rd Qu.:2005 3rd Qu.: 1.4050 3rd Qu.: 1.4090 3rd Qu.: 1.4090

7# Max. :2010 Max. : 12.0260 Max. : 12.0260 Max. : 12.0260

8# Lag4 Lag5 Volume Today

9# Min. :-18.1950 Min. :-18.1950 Min. :0.08747 Min. :-18.1950

10# 1st Qu.: -1.1580 1st Qu.: -1.1660 1st Qu.:0.33202 1st Qu.: -1.1540

11# Median : 0.2380 Median : 0.2340 Median :1.00268 Median : 0.2410

12# Mean : 0.1458 Mean : 0.1399 Mean :1.57462 Mean : 0.1499

13# 3rd Qu.: 1.4090 3rd Qu.: 1.4050 3rd Qu.:2.05373 3rd Qu.: 1.4050

14# Max. : 12.0260 Max. : 12.0260 Max. :9.32821 Max. : 12.0260

15# Direction

16# Down:484

17# Up :605

18#

19#

20#

21#

Unique Values

We might also want to know how many unique values are there in each column.

1weeklyDat %>% sapply(unique) %>% sapply(length)

1# Year Lag1 Lag2 Lag3 Lag4 Lag5 Volume Today

2# 21 1004 1005 1005 1005 1005 1089 1003

3# Direction

4# 2

We note that year has disproportionately lower values, something to keep in mind while constructing models later.

Range

The range of each variable might be useful as well, but we have to ignore the factor.

1weeklyDat %>% subset(select=-c(Direction)) %>% sapply(range)

1# Year Lag1 Lag2 Lag3 Lag4 Lag5 Volume Today

2# [1,] 1990 -18.195 -18.195 -18.195 -18.195 -18.195 0.087465 -18.195

3# [2,] 2010 12.026 12.026 12.026 12.026 12.026 9.328214 12.026

The most interesting thing about this is probably that the Lag

variables all have the same range, also something to be kept in mind

while applying transformations to the variable (if at all).

Mean and Std. Dev

By now we might have a pretty good idea of how this will look, but it is still worth seeing.

1weeklyDat %>% subset(select=-c(Direction)) %>% sapply(mean)

1# Year Lag1 Lag2 Lag3 Lag4 Lag5

2# 2000.0486685 0.1505849 0.1510790 0.1472048 0.1458182 0.1398926

3# Volume Today

4# 1.5746176 0.1498990

As expected, the Lag values have almost the same mean, what is a bit

interesting though, is that the Today variable has roughly the same

mean as the Lag variables.

1weeklyDat %>% subset(select=-c(Direction)) %>% sapply(sd)

1# Year Lag1 Lag2 Lag3 Lag4 Lag5 Volume Today

2# 6.033182 2.357013 2.357254 2.360502 2.360279 2.361285 1.686636 2.356927

This is largely redundant in terms of new information.

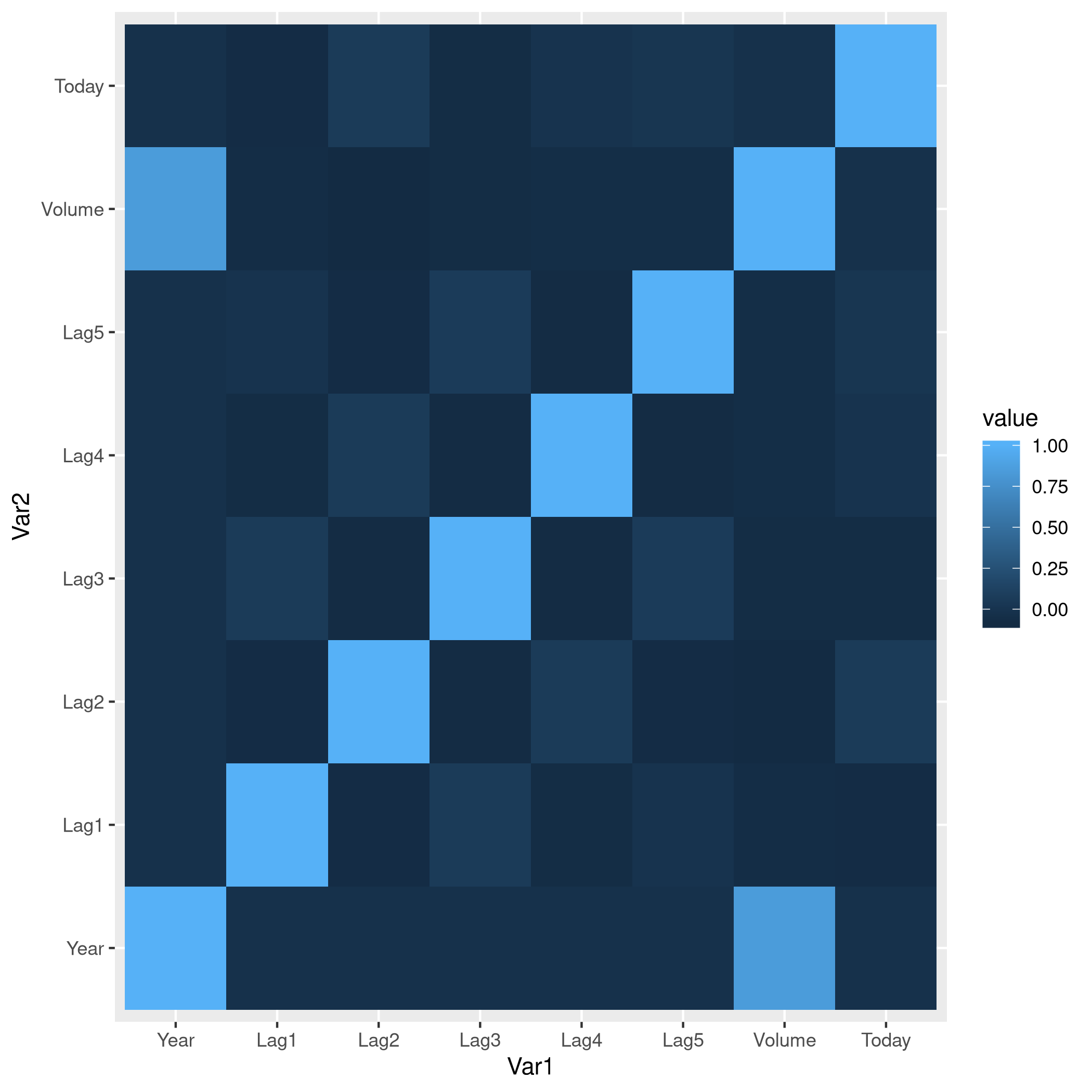

Correlations

1weeklyDat %>% subset(select=-c(Direction)) %>% cor

1# Year Lag1 Lag2 Lag3 Lag4

2# Year 1.00000000 -0.032289274 -0.03339001 -0.03000649 -0.031127923

3# Lag1 -0.03228927 1.000000000 -0.07485305 0.05863568 -0.071273876

4# Lag2 -0.03339001 -0.074853051 1.00000000 -0.07572091 0.058381535

5# Lag3 -0.03000649 0.058635682 -0.07572091 1.00000000 -0.075395865

6# Lag4 -0.03112792 -0.071273876 0.05838153 -0.07539587 1.000000000

7# Lag5 -0.03051910 -0.008183096 -0.07249948 0.06065717 -0.075675027

8# Volume 0.84194162 -0.064951313 -0.08551314 -0.06928771 -0.061074617

9# Today -0.03245989 -0.075031842 0.05916672 -0.07124364 -0.007825873

10# Lag5 Volume Today

11# Year -0.030519101 0.84194162 -0.032459894

12# Lag1 -0.008183096 -0.06495131 -0.075031842

13# Lag2 -0.072499482 -0.08551314 0.059166717

14# Lag3 0.060657175 -0.06928771 -0.071243639

15# Lag4 -0.075675027 -0.06107462 -0.007825873

16# Lag5 1.000000000 -0.05851741 0.011012698

17# Volume -0.058517414 1.00000000 -0.033077783

18# Today 0.011012698 -0.03307778 1.000000000

Useful though this is, it is kind of difficult to work with, in this form, so we might as well programmatic-ally remove strongly correlated data instead.

1# Uses caret

2corrCols=weeklyDat %>% subset(select=-c(Direction)) %>% cor %>% findCorrelation(cutoff=0.8)

3reducedDat<-weeklyDat[-c(corrCols)]

4reducedDat %>% summary

1# Year Lag1 Lag2 Lag3

2# Min. :1990 Min. :-18.1950 Min. :-18.1950 Min. :-18.1950

3# 1st Qu.:1995 1st Qu.: -1.1540 1st Qu.: -1.1540 1st Qu.: -1.1580

4# Median :2000 Median : 0.2410 Median : 0.2410 Median : 0.2410

5# Mean :2000 Mean : 0.1506 Mean : 0.1511 Mean : 0.1472

6# 3rd Qu.:2005 3rd Qu.: 1.4050 3rd Qu.: 1.4090 3rd Qu.: 1.4090

7# Max. :2010 Max. : 12.0260 Max. : 12.0260 Max. : 12.0260

8# Lag4 Lag5 Today Direction

9# Min. :-18.1950 Min. :-18.1950 Min. :-18.1950 Down:484

10# 1st Qu.: -1.1580 1st Qu.: -1.1660 1st Qu.: -1.1540 Up :605

11# Median : 0.2380 Median : 0.2340 Median : 0.2410

12# Mean : 0.1458 Mean : 0.1399 Mean : 0.1499

13# 3rd Qu.: 1.4090 3rd Qu.: 1.4050 3rd Qu.: 1.4050

14# Max. : 12.0260 Max. : 12.0260 Max. : 12.0260

We can see that the Volume variable has been dropped, since it

evidently is strongly correlated with Year. This may or may not be a

useful insight, but it is good to keep in mind.

Visualization

We will be using the ggplot2 library throughout for this segment.

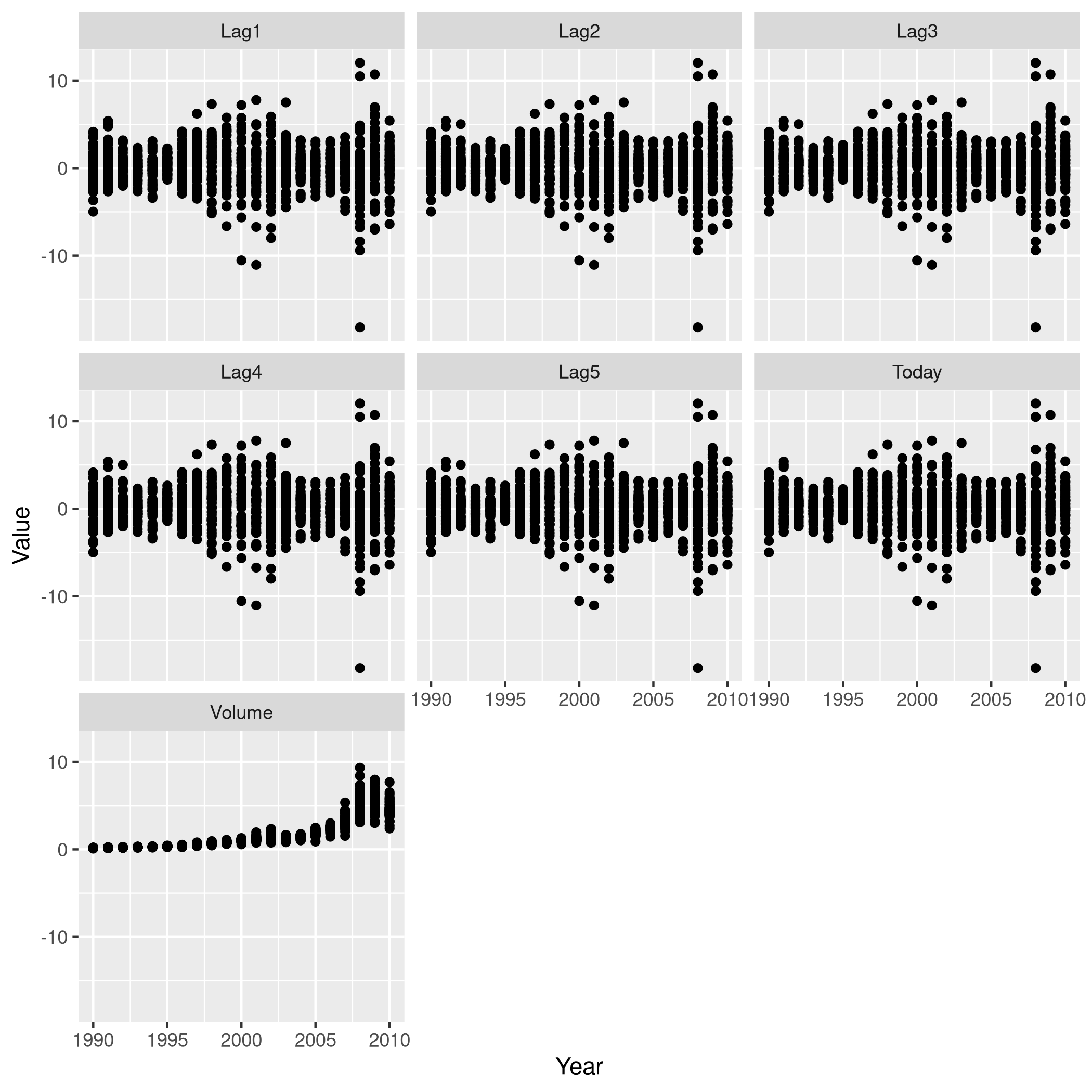

Lets start with some scatter plots in a one v/s all scheme, similar to the methodology described here.

1weeklyDat %>% subset(select=-c(Direction)) %>% gather(-Year,key="Variable", value="Value") %>% ggplot(aes(x=Value,y=Year)) +

2 geom_point() +

3 facet_wrap(~Variable) +

4 coord_flip()

Figure 1: One v/s all for Direction

That didn’t really tell us much which we didn’t already get from the

cor() function, but we can go the whole hog and do this for every

variable since we don’t have that many in the first place..

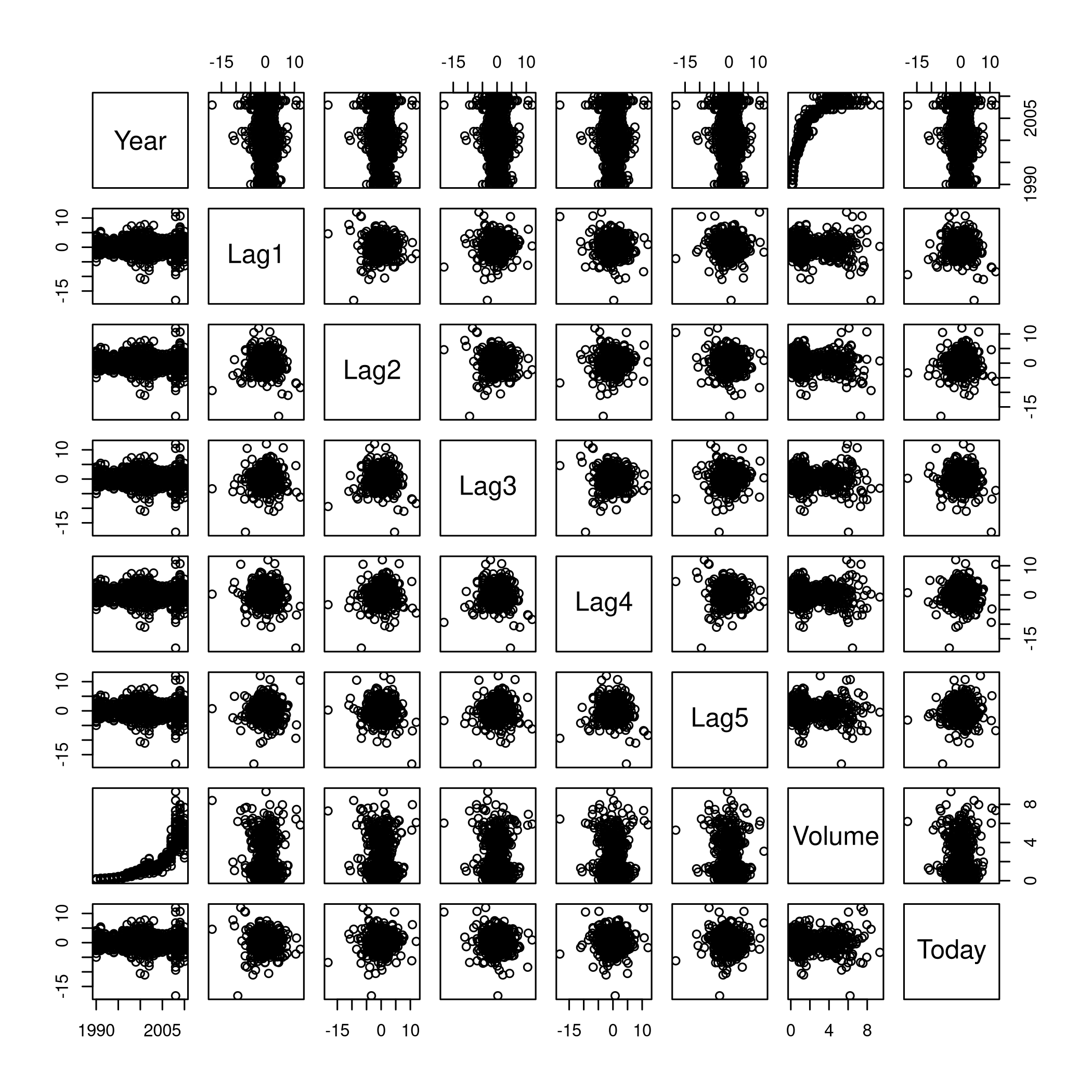

1weeklyDat %>% subset(select=-c(Direction)) %>% pairs

Figure 2: Pairs

This is not especially useful, and it is doubtful if more scatter-plots will help at all, so lets move on to box plots.

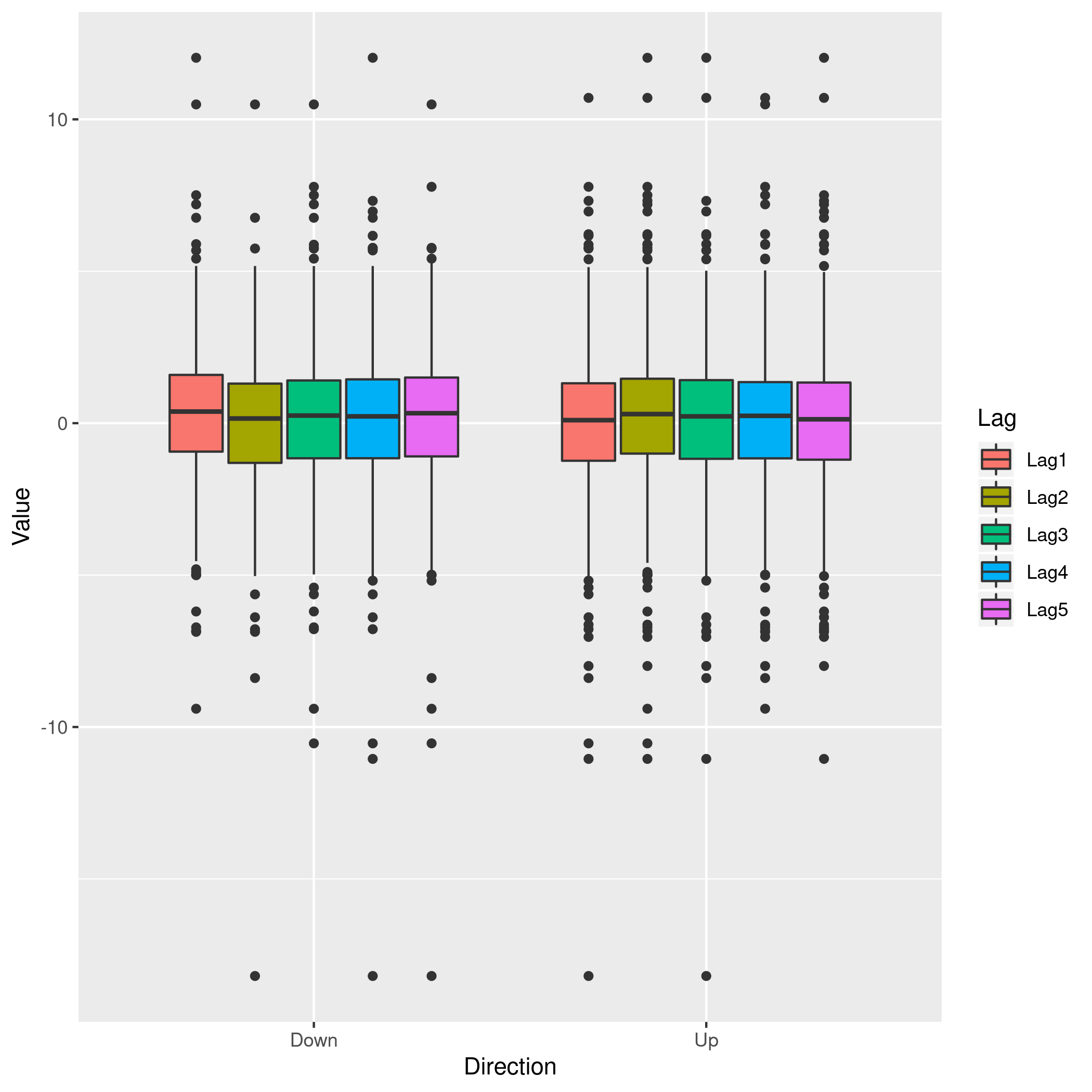

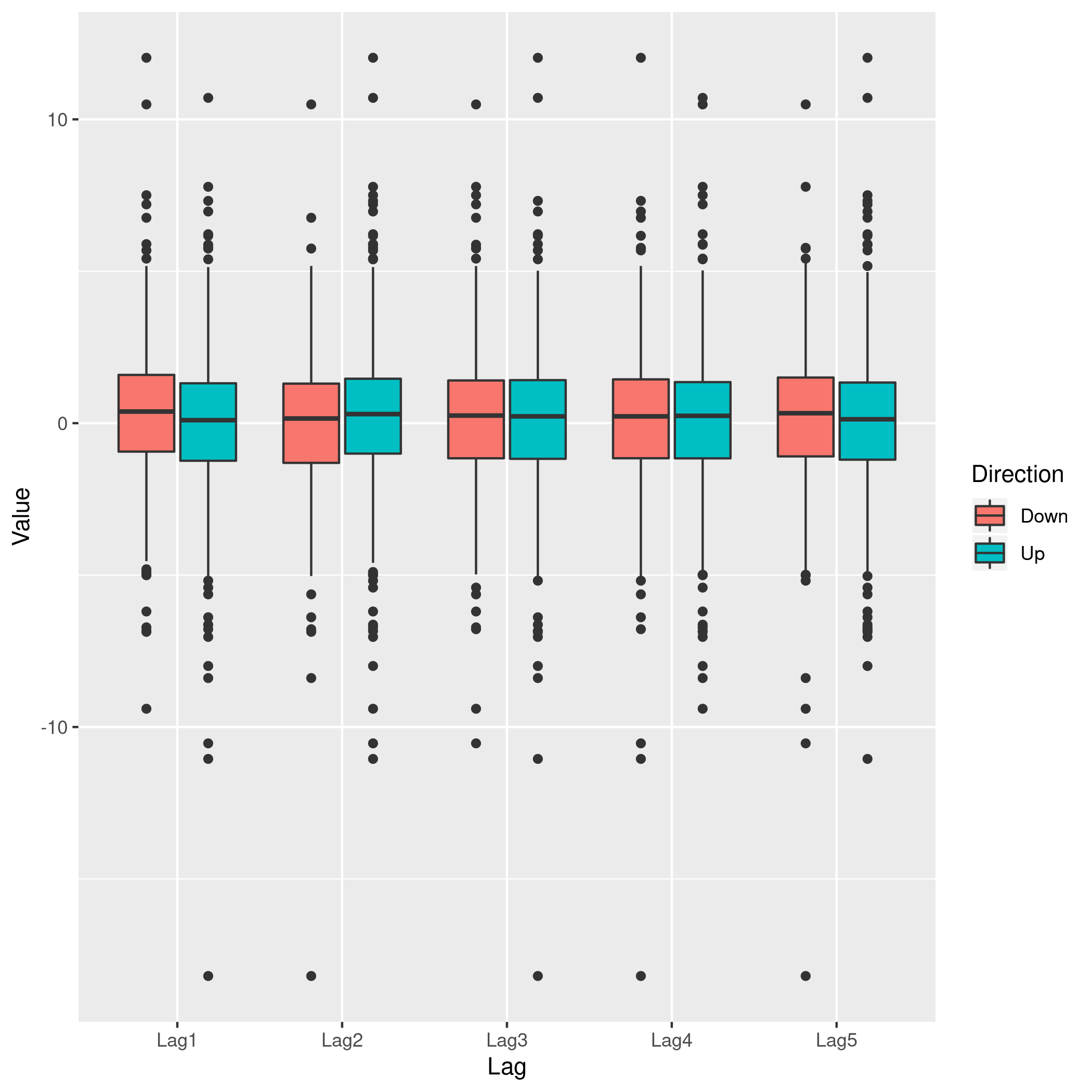

1weeklyDat %>% pivot_longer(-c(Direction,Volume,Today,Year),names_to="Lag",values_to="Value") %>% ggplot(aes(x=Direction,y=Value,fill=Lag)) +

2 geom_boxplot()

Figure 3: Box plots for Direction

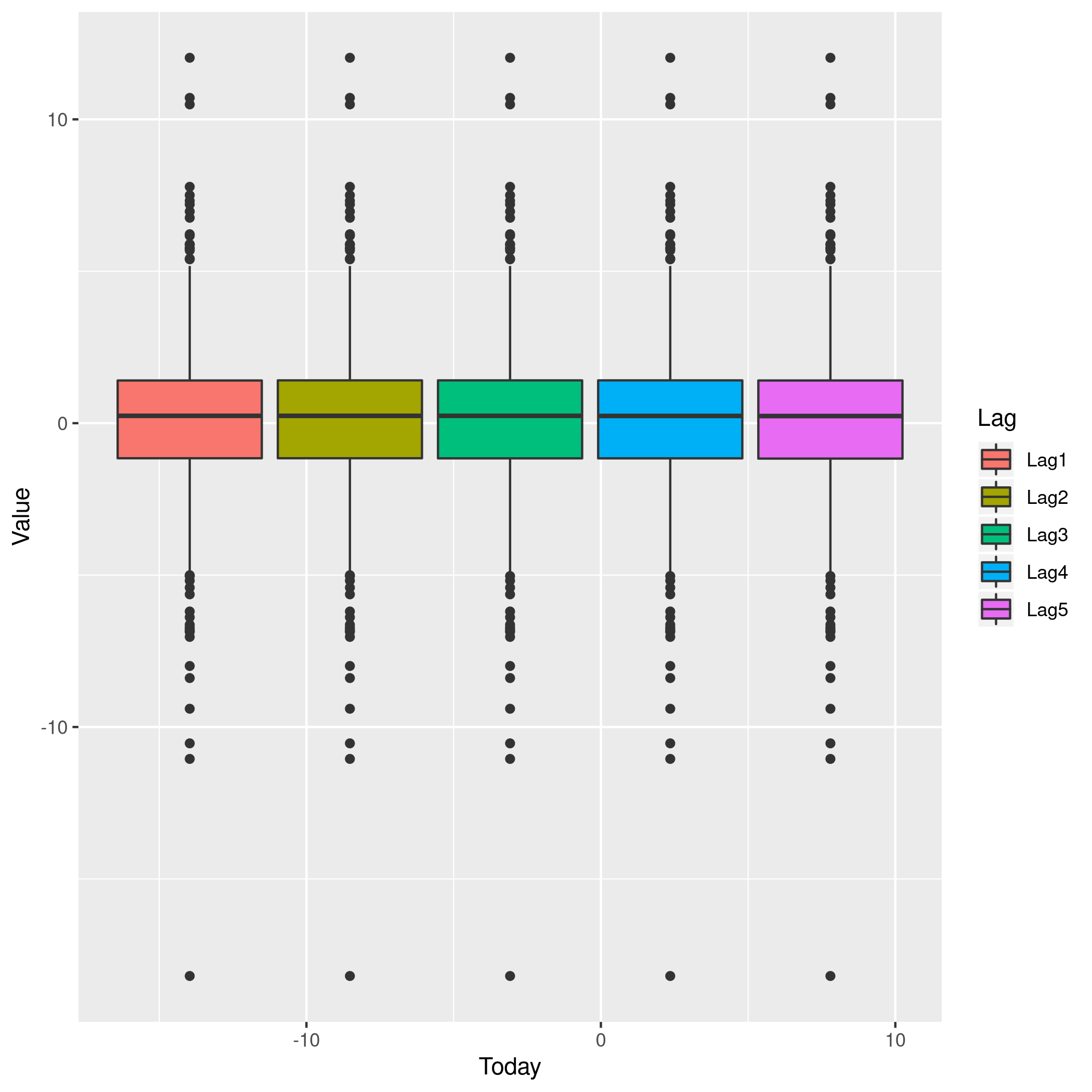

1weeklyDat %>% pivot_longer(-c(Direction,Volume,Today,Year),names_to="Lag",values_to="Value") %>% ggplot(aes(x=Today,y=Value,fill=Lag)) +

2 geom_boxplot()

Figure 4: More box plots

1weeklyDat %>% pivot_longer(-c(Direction,Volume,Today,Year),names_to="Lag",values_to="Value") %>% ggplot(aes(x=Lag,y=Value,fill=Direction)) +

2 geom_boxplot()

Figure 5: Lag v/s all

This does summarize our text analysis quite well. Importantly, it tells

us that the Today value is largely unrelated to the \(4\) Lag

variables.

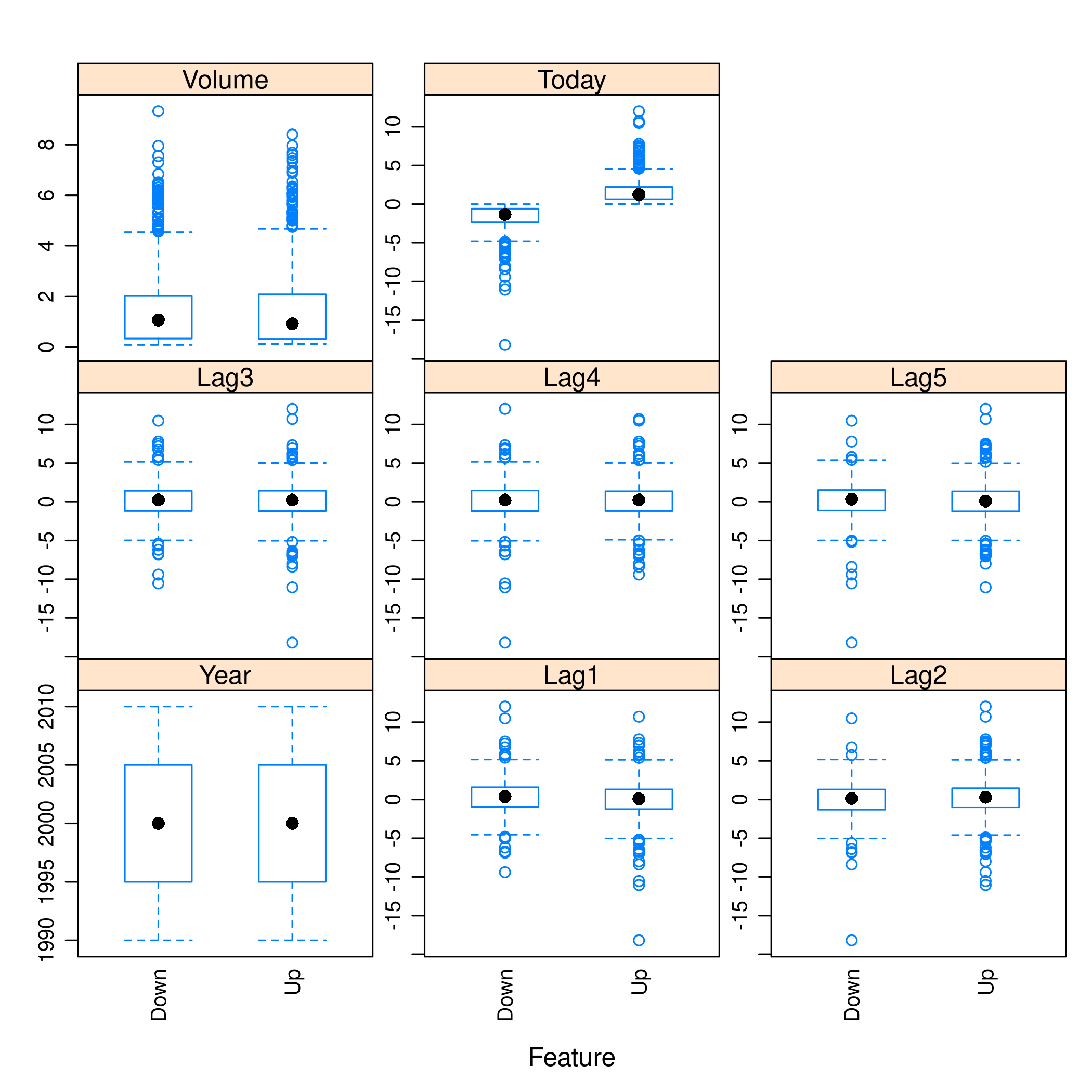

A really good-looking box-plot is easy to get with the caret library:

1weeklyDat %>% subset(select=-c(Direction)) %>% featurePlot(

2 y = weeklyDat$Direction,

3 plot = "box",

4 # Pass in options to bwplot()

5 scales = list(y = list(relation="free"),

6 x = list(rot = 90)),

7 auto.key = list(columns = 2))

Figure 6: Plots with caret

We might want to visualize our correlation matrix as well.

1library(reshape2)

1#

2# Attaching package: 'reshape2'

1# The following object is masked from 'package:tidyr':

2#

3# smiths

1weeklyDat %>% subset(select=-c(Direction)) %>% cor %>% melt %>% ggplot(aes(x=Var1,y=Var2,fill=value)) +

2 geom_tile()

Figure 7: Heatmap of the correlation matrix

b) Logistic Regression - Predictor Significance

Lets start with the native glm function.

1glm.fit=glm(Direction~Lag1+Lag2+Lag3+Lag4+Lag5+Volume, data=weeklyDat, family=binomial)

2summary(glm.fit)

1#

2# Call:

3# glm(formula = Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 +

4# Volume, family = binomial, data = weeklyDat)

5#

6# Deviance Residuals:

7# Min 1Q Median 3Q Max

8# -1.6949 -1.2565 0.9913 1.0849 1.4579

9#

10# Coefficients:

11# Estimate Std. Error z value Pr(>|z|)

12# (Intercept) 0.26686 0.08593 3.106 0.0019 **

13# Lag1 -0.04127 0.02641 -1.563 0.1181

14# Lag2 0.05844 0.02686 2.175 0.0296 *

15# Lag3 -0.01606 0.02666 -0.602 0.5469

16# Lag4 -0.02779 0.02646 -1.050 0.2937

17# Lag5 -0.01447 0.02638 -0.549 0.5833

18# Volume -0.02274 0.03690 -0.616 0.5377

19# ---

20# Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

21#

22# (Dispersion parameter for binomial family taken to be 1)

23#

24# Null deviance: 1496.2 on 1088 degrees of freedom

25# Residual deviance: 1486.4 on 1082 degrees of freedom

26# AIC: 1500.4

27#

28# Number of Fisher Scoring iterations: 4

Evidently, only the Lag2 value is of statistical significance.

It is always of importance to figure out what numeric values R will assign to our factors, and it is best not to guess.

1contrasts(weeklyDat$Direction)

1# Up

2# Down 0

3# Up 1

c) Confusion Matrix and Metrics

Essentially:

- Predict the response

- Create an output length vector

- Apply thresholding to obtain labels

1glm.probs = predict(glm.fit, type = "response")

2glm.pred = rep("Up",length(glm.probs))

3glm.pred[glm.probs<0.5]="Down"

4glm.pred=factor(glm.pred)

5confusionMatrix(glm.pred,weeklyDat$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 54 48

6# Up 430 557

7#

8# Accuracy : 0.5611

9# 95% CI : (0.531, 0.5908)

10# No Information Rate : 0.5556

11# P-Value [Acc > NIR] : 0.369

12#

13# Kappa : 0.035

14#

15# Mcnemar's Test P-Value : <2e-16

16#

17# Sensitivity : 0.11157

18# Specificity : 0.92066

19# Pos Pred Value : 0.52941

20# Neg Pred Value : 0.56434

21# Prevalence : 0.44444

22# Detection Rate : 0.04959

23# Detection Prevalence : 0.09366

24# Balanced Accuracy : 0.51612

25#

26# 'Positive' Class : Down

27#

- We have used the

confusionMatrixfunction fromcaret(documented here) instead of displaying the results withtableand then calculating precision, recall and the rest by hand.

d) Train Test Splits

Although we could have used the indices and passed it to glm as the

subset attribute, it is cleaner to just make subsets instead.

1weeklyVal<-weeklyDat %>% filter(Year>=2009)

2weeklyTrain<-weeklyDat %>% filter(Year<2009)

Now we can train a model on our training data.

1glm.fit=glm(Direction~Lag2,data=weeklyTrain,family=binomial)

2summary(glm.fit)

1#

2# Call:

3# glm(formula = Direction ~ Lag2, family = binomial, data = weeklyTrain)

4#

5# Deviance Residuals:

6# Min 1Q Median 3Q Max

7# -1.536 -1.264 1.021 1.091 1.368

8#

9# Coefficients:

10# Estimate Std. Error z value Pr(>|z|)

11# (Intercept) 0.20326 0.06428 3.162 0.00157 **

12# Lag2 0.05810 0.02870 2.024 0.04298 *

13# ---

14# Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

15#

16# (Dispersion parameter for binomial family taken to be 1)

17#

18# Null deviance: 1354.7 on 984 degrees of freedom

19# Residual deviance: 1350.5 on 983 degrees of freedom

20# AIC: 1354.5

21#

22# Number of Fisher Scoring iterations: 4

Having fit our model, we will test the predictions on our held out data.

1glm.probs = predict(glm.fit,weeklyVal, type = "response")

2glm.pred = rep("Up",length(glm.probs))

3glm.pred[glm.probs<0.5]="Down"

4glm.pred=factor(glm.pred)

5confusionMatrix(glm.pred,weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 9 5

6# Up 34 56

7#

8# Accuracy : 0.625

9# 95% CI : (0.5247, 0.718)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.2439

12#

13# Kappa : 0.1414

14#

15# Mcnemar's Test P-Value : 7.34e-06

16#

17# Sensitivity : 0.20930

18# Specificity : 0.91803

19# Pos Pred Value : 0.64286

20# Neg Pred Value : 0.62222

21# Prevalence : 0.41346

22# Detection Rate : 0.08654

23# Detection Prevalence : 0.13462

24# Balanced Accuracy : 0.56367

25#

26# 'Positive' Class : Down

27#

We really aren’t doing very well with this single variable model as is evident.

e) LDA models

At this stage we could use MASS to get the lda function, but it

would be better to just switch to using caret. Note that the caret

prediction is a label by default, so thresholding needs to be specified

differently if required.

1lda.fit=train(Direction~Lag2,data=weeklyTrain,method="lda")

2summary(lda.fit)

1# Length Class Mode

2# prior 2 -none- numeric

3# counts 2 -none- numeric

4# means 2 -none- numeric

5# scaling 1 -none- numeric

6# lev 2 -none- character

7# svd 1 -none- numeric

8# N 1 -none- numeric

9# call 3 -none- call

10# xNames 1 -none- character

11# problemType 1 -none- character

12# tuneValue 1 data.frame list

13# obsLevels 2 -none- character

14# param 0 -none- list

1predict(lda.fit,weeklyVal) %>% confusionMatrix(weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 9 5

6# Up 34 56

7#

8# Accuracy : 0.625

9# 95% CI : (0.5247, 0.718)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.2439

12#

13# Kappa : 0.1414

14#

15# Mcnemar's Test P-Value : 7.34e-06

16#

17# Sensitivity : 0.20930

18# Specificity : 0.91803

19# Pos Pred Value : 0.64286

20# Neg Pred Value : 0.62222

21# Prevalence : 0.41346

22# Detection Rate : 0.08654

23# Detection Prevalence : 0.13462

24# Balanced Accuracy : 0.56367

25#

26# 'Positive' Class : Down

27#

f) QDA models

1qda.fit=train(Direction~Lag2,data=weeklyTrain,method="qda")

2summary(qda.fit)

1# Length Class Mode

2# prior 2 -none- numeric

3# counts 2 -none- numeric

4# means 2 -none- numeric

5# scaling 2 -none- numeric

6# ldet 2 -none- numeric

7# lev 2 -none- character

8# N 1 -none- numeric

9# call 3 -none- call

10# xNames 1 -none- character

11# problemType 1 -none- character

12# tuneValue 1 data.frame list

13# obsLevels 2 -none- character

14# param 0 -none- list

1predict(qda.fit,weeklyVal) %>% confusionMatrix(weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 0 0

6# Up 43 61

7#

8# Accuracy : 0.5865

9# 95% CI : (0.4858, 0.6823)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.5419

12#

13# Kappa : 0

14#

15# Mcnemar's Test P-Value : 1.504e-10

16#

17# Sensitivity : 0.0000

18# Specificity : 1.0000

19# Pos Pred Value : NaN

20# Neg Pred Value : 0.5865

21# Prevalence : 0.4135

22# Detection Rate : 0.0000

23# Detection Prevalence : 0.0000

24# Balanced Accuracy : 0.5000

25#

26# 'Positive' Class : Down

27#

This is quite possibly the worst of the lot. As is evident, the model

just predicts Up no matter what.

g) KNN

caret tends to over-zealously retrain models and find the best

possible parameters. In this case that is annoying and redundant so we

will use the class library. We should really scale our data before

using KNN though.

1library(class)

2set.seed(1)

3knn.pred=knn(as.matrix(weeklyTrain$Lag2),as.matrix(weeklyVal$Lag2),weeklyTrain$Direction,k=1)

4confusionMatrix(knn.pred,weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 21 30

6# Up 22 31

7#

8# Accuracy : 0.5

9# 95% CI : (0.4003, 0.5997)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.9700

12#

13# Kappa : -0.0033

14#

15# Mcnemar's Test P-Value : 0.3317

16#

17# Sensitivity : 0.4884

18# Specificity : 0.5082

19# Pos Pred Value : 0.4118

20# Neg Pred Value : 0.5849

21# Prevalence : 0.4135

22# Detection Rate : 0.2019

23# Detection Prevalence : 0.4904

24# Balanced Accuracy : 0.4983

25#

26# 'Positive' Class : Down

27#

Clearly this model is not doing very well.

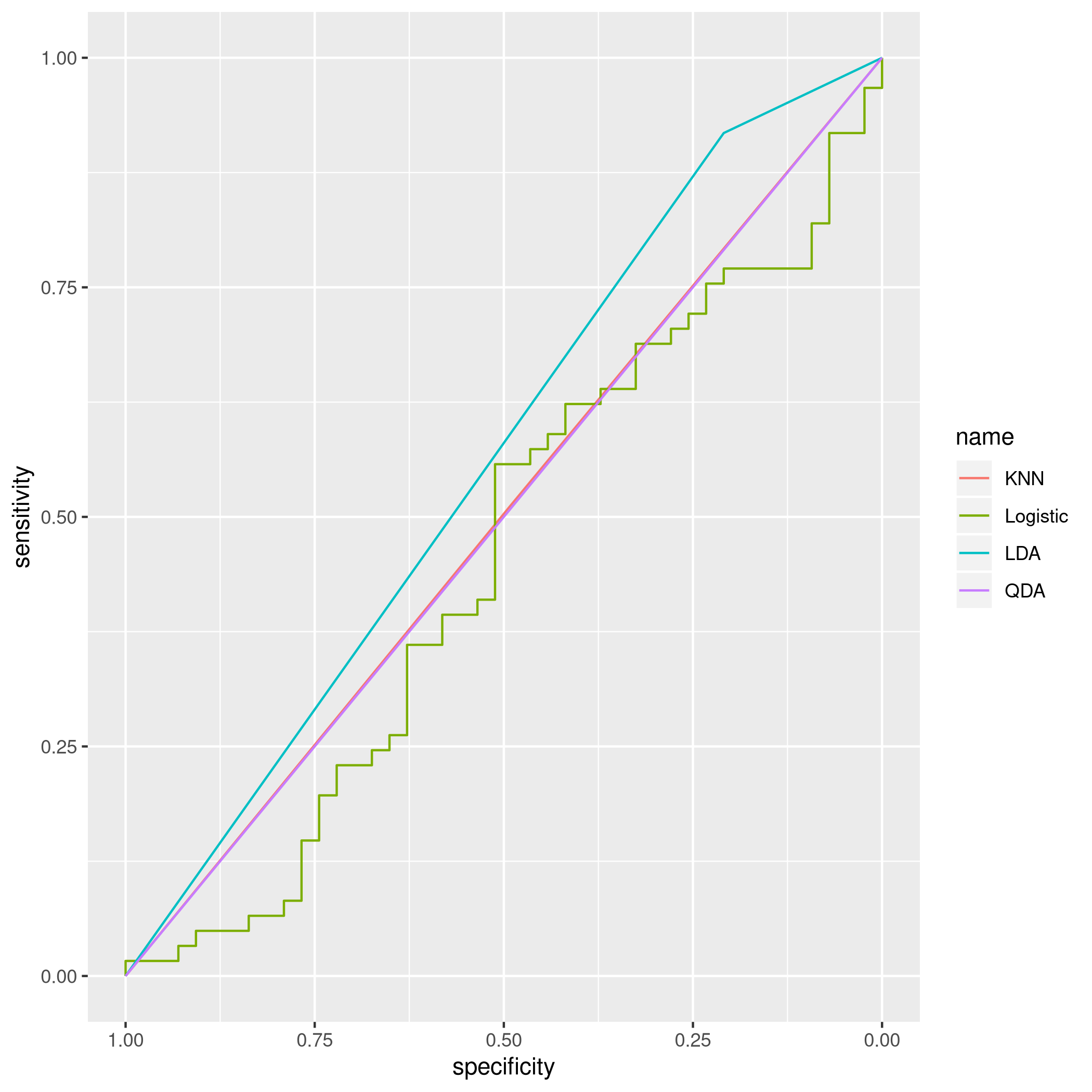

h) Model Selection

We will first get the ROC curves.

1library(pROC)

1# Type 'citation("pROC")' for a citation.

1#

2# Attaching package: 'pROC'

1# The following objects are masked from 'package:stats':

2#

3# cov, smooth, var

1knnROC<-roc(predictor=as.numeric(knn.pred),response=weeklyVal$Direction,levels=rev(levels(weeklyVal$Direction)))

1# Setting direction: controls < cases

1logiROC<-roc(predictor=as.numeric(predict(glm.fit,weeklyVal)),response=weeklyVal$Direction)

1# Setting levels: control = Down, case = Up

1# Setting direction: controls > cases

1ldaROC<-roc(predictor=as.numeric(predict(lda.fit,weeklyVal)),response=weeklyVal$Direction)

1# Setting levels: control = Down, case = Up

1# Setting direction: controls < cases

1qdaROC<-roc(predictor=as.numeric(predict(qda.fit,weeklyVal)),response=weeklyVal$Direction)

1# Setting levels: control = Down, case = Up

2# Setting direction: controls < cases

Now to plot them.

1ggroc(list(KNN=knnROC,Logistic=logiROC,LDA=ldaROC,QDA=qdaROC))

Figure 8: ROC curves for Weekly data

To compare models with caret it is easy to refit the logistic and knn

models in the caret formulation.

1knnCaret=train(Direction~Lag2,data=weeklyTrain,method="knn")

However, the KNN model is the best parameter model.

1resmod <- resamples(list(lda=lda.fit, qda=qda.fit, KNN=knnCaret))

2summary(resmod)

1#

2# Call:

3# summary.resamples(object = resmod)

4#

5# Models: lda, qda, KNN

6# Number of resamples: 25

7#

8# Accuracy

9# Min. 1st Qu. Median Mean 3rd Qu. Max. NA's

10# lda 0.5043228 0.5344353 0.5529101 0.5500861 0.5683060 0.5846995 0

11# qda 0.5044248 0.5204360 0.5307263 0.5326785 0.5462428 0.5777778 0

12# KNN 0.4472222 0.5082873 0.5240642 0.5168327 0.5302198 0.5485714 0

13#

14# Kappa

15# Min. 1st Qu. Median Mean 3rd Qu. Max.

16# lda -0.02618939 -0.003638168 0.005796908 0.007801904 0.01635328 0.05431238

17# qda -0.06383592 -0.005606123 0.000000000 -0.003229697 0.00000000 0.03606344

18# KNN -0.11297539 0.004168597 0.024774647 0.016171229 0.04456142 0.07724439

19# NA's

20# lda 0

21# qda 0

22# KNN 0

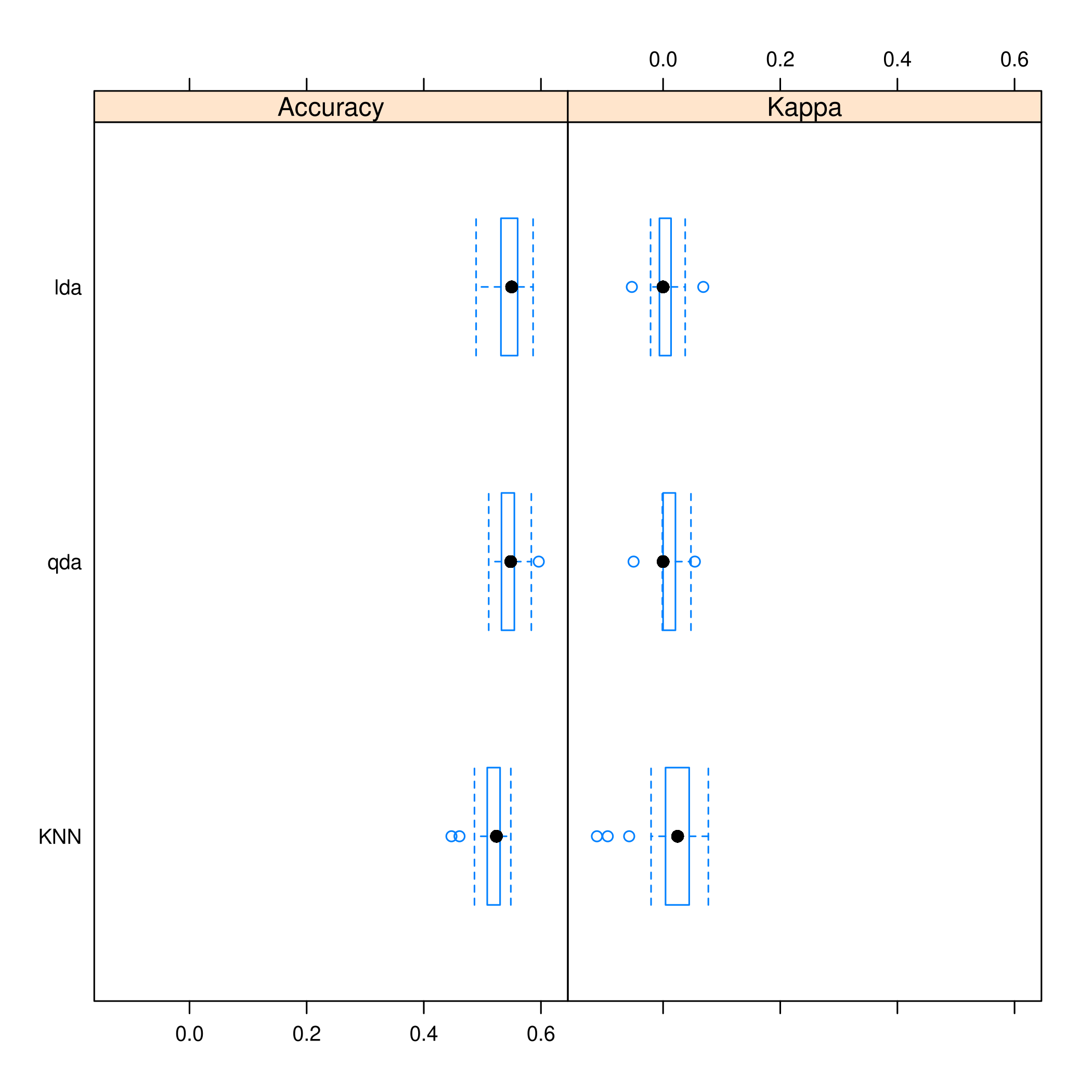

1bwplot(resmod)

Figure 9: Caret plots for comparison

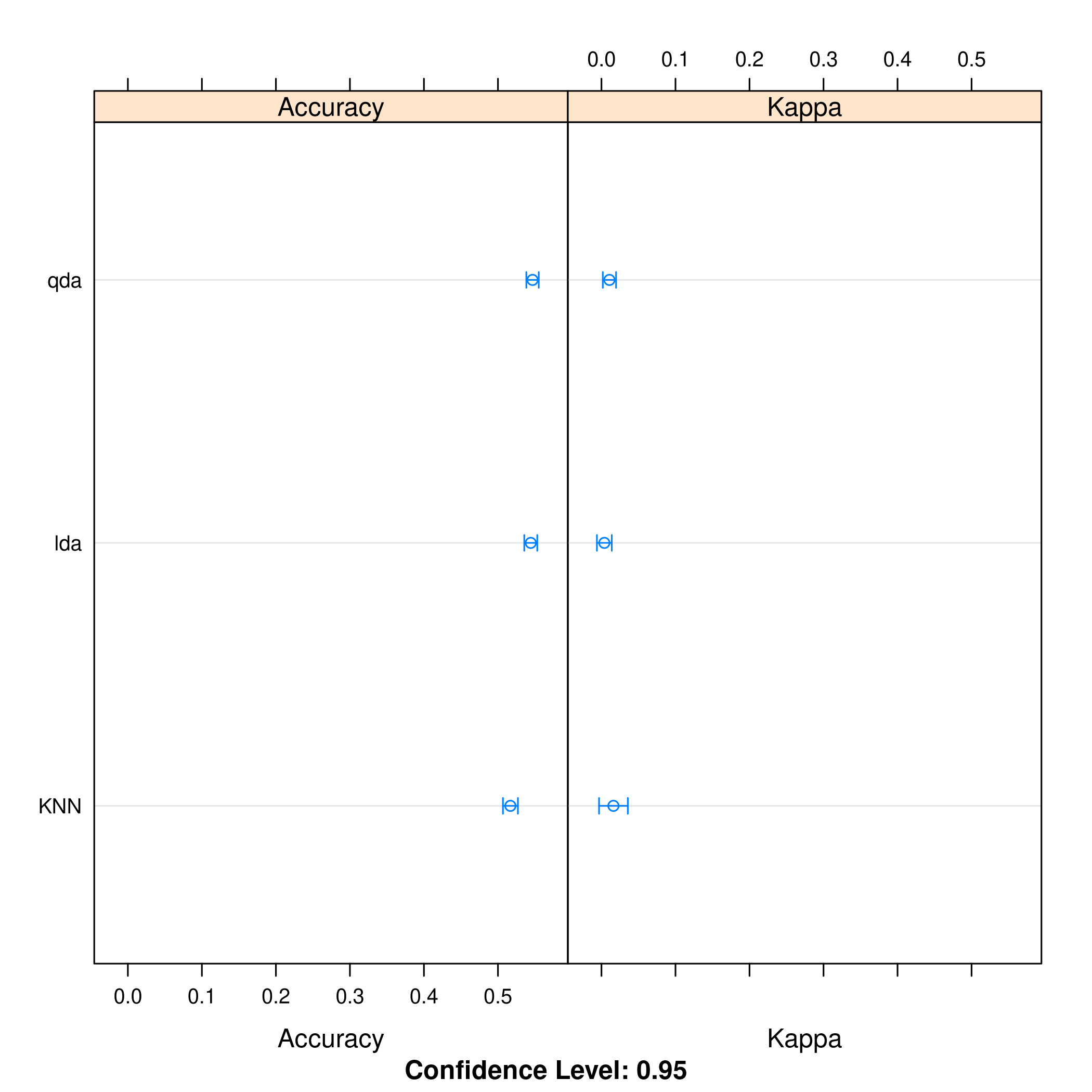

1dotplot(resmod)

Kappa or Cohen’s Kappa is essentially classification accuracy, normalized at the baseline of random chance. It is a more useful measure to use on problems that have imbalanced classes. There’s more on model selection here.

i) Further Tuning

Do note the caret

defaults.

1fitControl <- trainControl(# 10-fold CV

2 method = "repeatedcv",

3 number = 10,

4 # repeated ten times

5 repeats = 10)

Logistic

1glm2.fit=glm(Direction~Lag1+Lag2+Lag3+Lag4+Lag5+Volume, data=weeklyDat, family=binomial)

2

3glm2.probs = predict(glm2.fit,weeklyVal, type = "response")

4glm2.pred = rep("Up",length(glm2.probs))

5glm2.pred[glm2.probs<0.5]="Down"

6glm2.pred=factor(glm2.pred)

7confusionMatrix(glm2.pred,weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 17 13

6# Up 26 48

7#

8# Accuracy : 0.625

9# 95% CI : (0.5247, 0.718)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.24395

12#

13# Kappa : 0.1907

14#

15# Mcnemar's Test P-Value : 0.05466

16#

17# Sensitivity : 0.3953

18# Specificity : 0.7869

19# Pos Pred Value : 0.5667

20# Neg Pred Value : 0.6486

21# Prevalence : 0.4135

22# Detection Rate : 0.1635

23# Detection Prevalence : 0.2885

24# Balanced Accuracy : 0.5911

25#

26# 'Positive' Class : Down

27#

QDA

1qdaCaret=train(Direction~Lag2+Lag4,data=weeklyTrain,method="qda",trainControl=fitControl)

1summary(qdaCaret)

1# Length Class Mode

2# prior 2 -none- numeric

3# counts 2 -none- numeric

4# means 4 -none- numeric

5# scaling 8 -none- numeric

6# ldet 2 -none- numeric

7# lev 2 -none- character

8# N 1 -none- numeric

9# call 4 -none- call

10# xNames 2 -none- character

11# problemType 1 -none- character

12# tuneValue 1 data.frame list

13# obsLevels 2 -none- character

14# param 1 -none- list

1predict(qdaCaret,weeklyVal) %>% confusionMatrix(weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 9 14

6# Up 34 47

7#

8# Accuracy : 0.5385

9# 95% CI : (0.438, 0.6367)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.863079

12#

13# Kappa : -0.0217

14#

15# Mcnemar's Test P-Value : 0.006099

16#

17# Sensitivity : 0.20930

18# Specificity : 0.77049

19# Pos Pred Value : 0.39130

20# Neg Pred Value : 0.58025

21# Prevalence : 0.41346

22# Detection Rate : 0.08654

23# Detection Prevalence : 0.22115

24# Balanced Accuracy : 0.48990

25#

26# 'Positive' Class : Down

27#

LDA

1ldaCaret=train(Direction~Lag2+Lag1+Year,data=weeklyTrain,method="lda",trainControl=fitControl)

1summary(ldaCaret)

1# Length Class Mode

2# prior 2 -none- numeric

3# counts 2 -none- numeric

4# means 6 -none- numeric

5# scaling 3 -none- numeric

6# lev 2 -none- character

7# svd 1 -none- numeric

8# N 1 -none- numeric

9# call 4 -none- call

10# xNames 3 -none- character

11# problemType 1 -none- character

12# tuneValue 1 data.frame list

13# obsLevels 2 -none- character

14# param 1 -none- list

1predict(ldaCaret,weeklyVal) %>% confusionMatrix(weeklyVal$Direction)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction Down Up

5# Down 20 19

6# Up 23 42

7#

8# Accuracy : 0.5962

9# 95% CI : (0.4954, 0.6913)

10# No Information Rate : 0.5865

11# P-Value [Acc > NIR] : 0.4626

12#

13# Kappa : 0.1558

14#

15# Mcnemar's Test P-Value : 0.6434

16#

17# Sensitivity : 0.4651

18# Specificity : 0.6885

19# Pos Pred Value : 0.5128

20# Neg Pred Value : 0.6462

21# Prevalence : 0.4135

22# Detection Rate : 0.1923

23# Detection Prevalence : 0.3750

24# Balanced Accuracy : 0.5768

25#

26# 'Positive' Class : Down

27#

KNN

Honestly, again, this should be scaled. Plot KNN with the best

parameters.

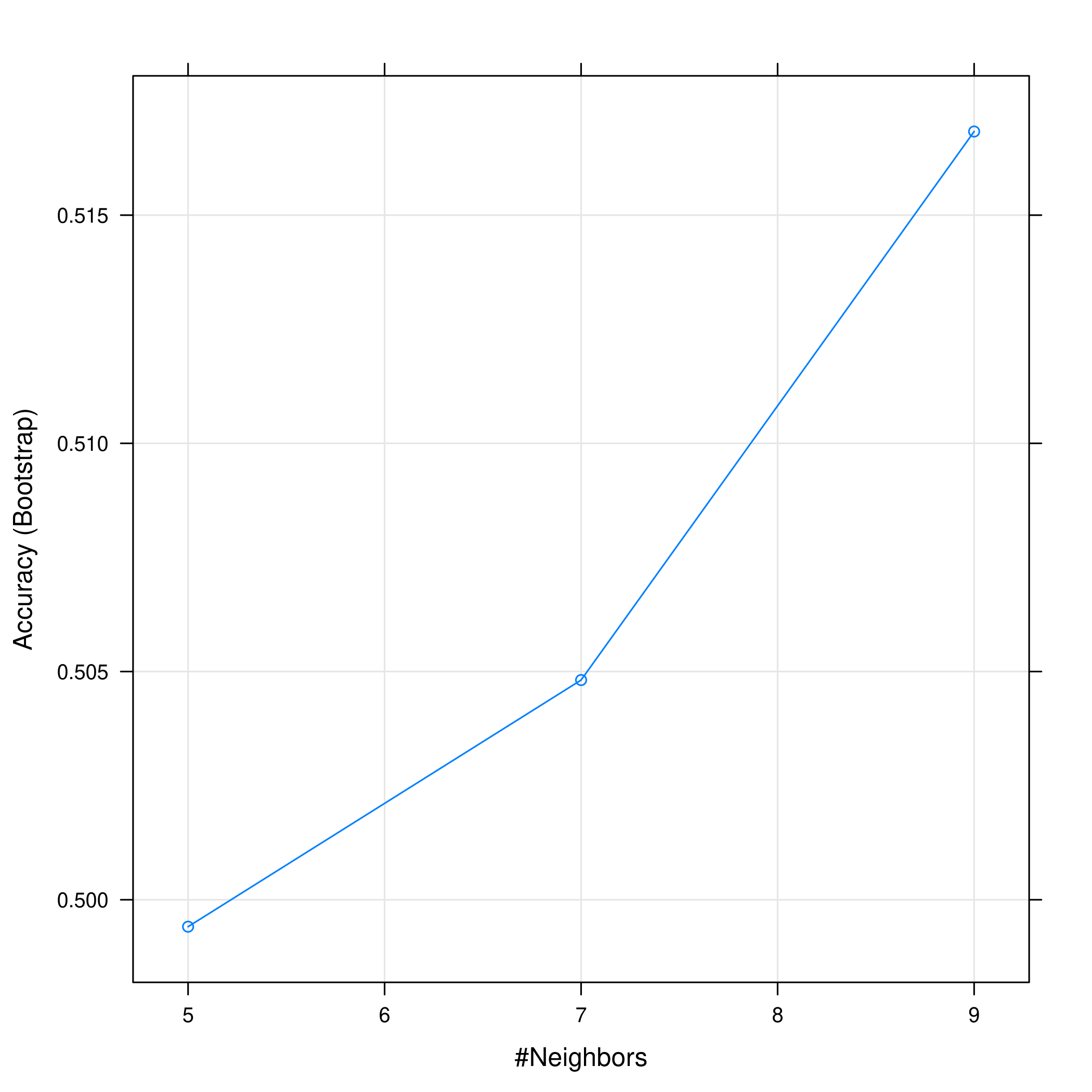

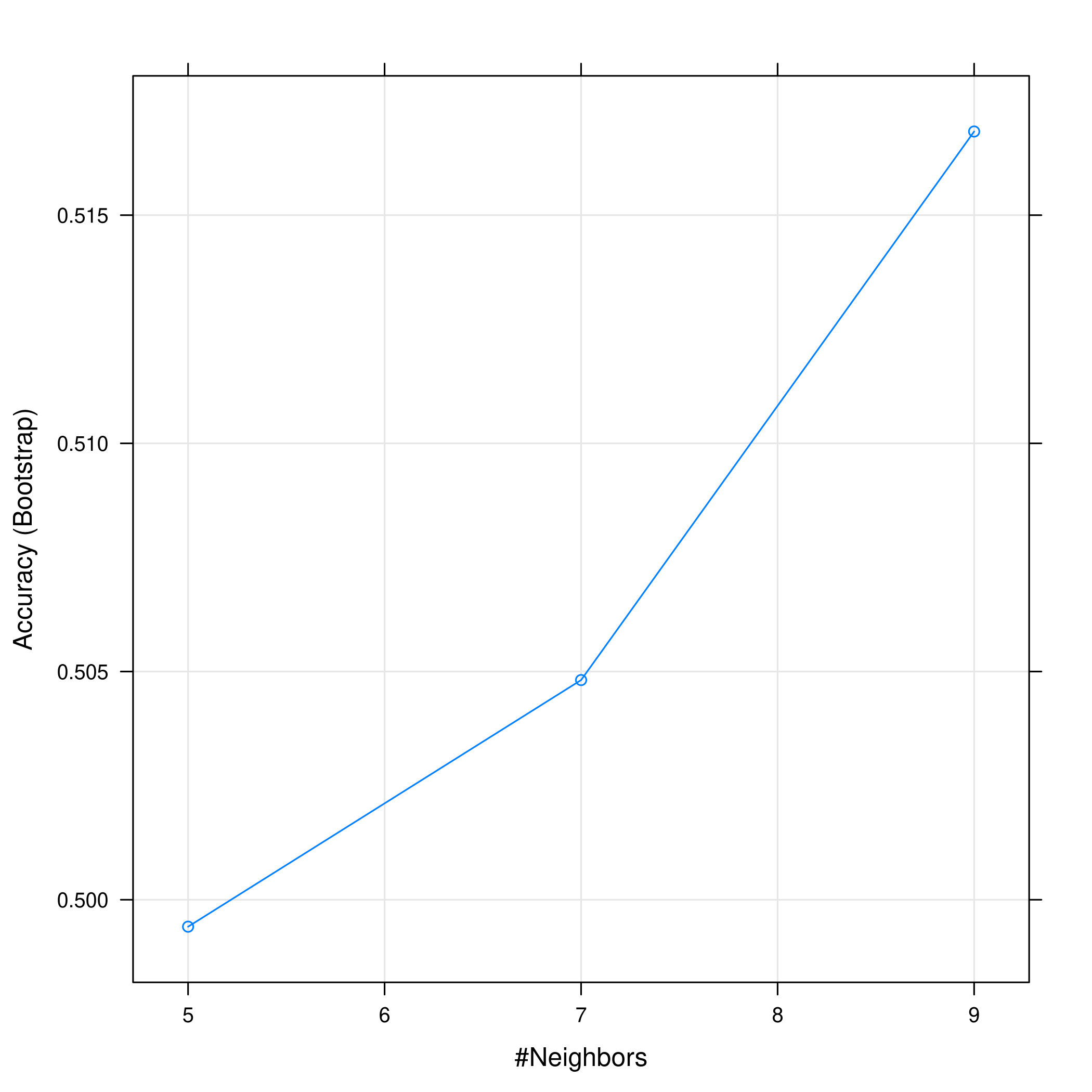

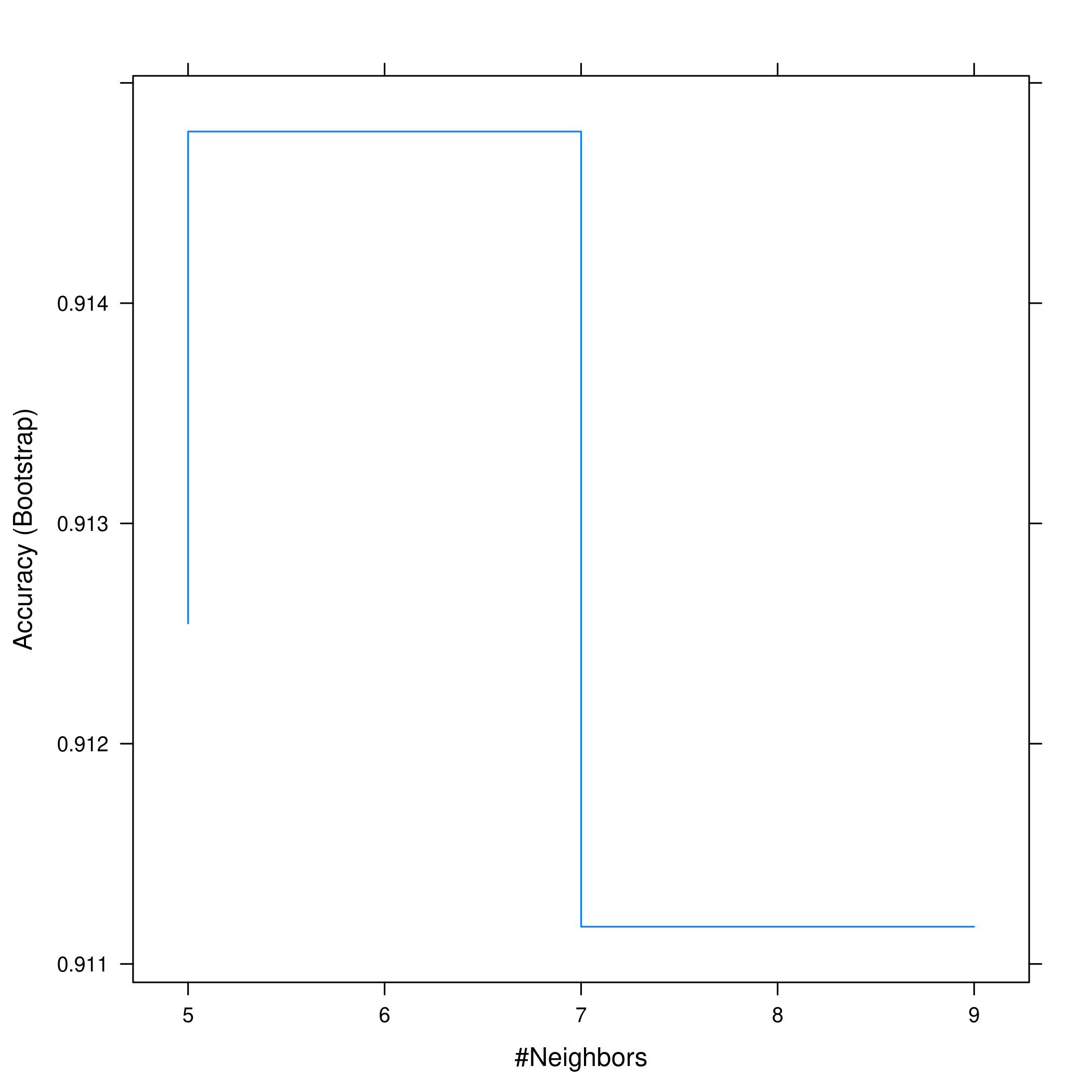

1plot(knnCaret)

Figure 10: KNN statistics

Evidently, the accuracy increases with an increase in the number of neighbors considered.

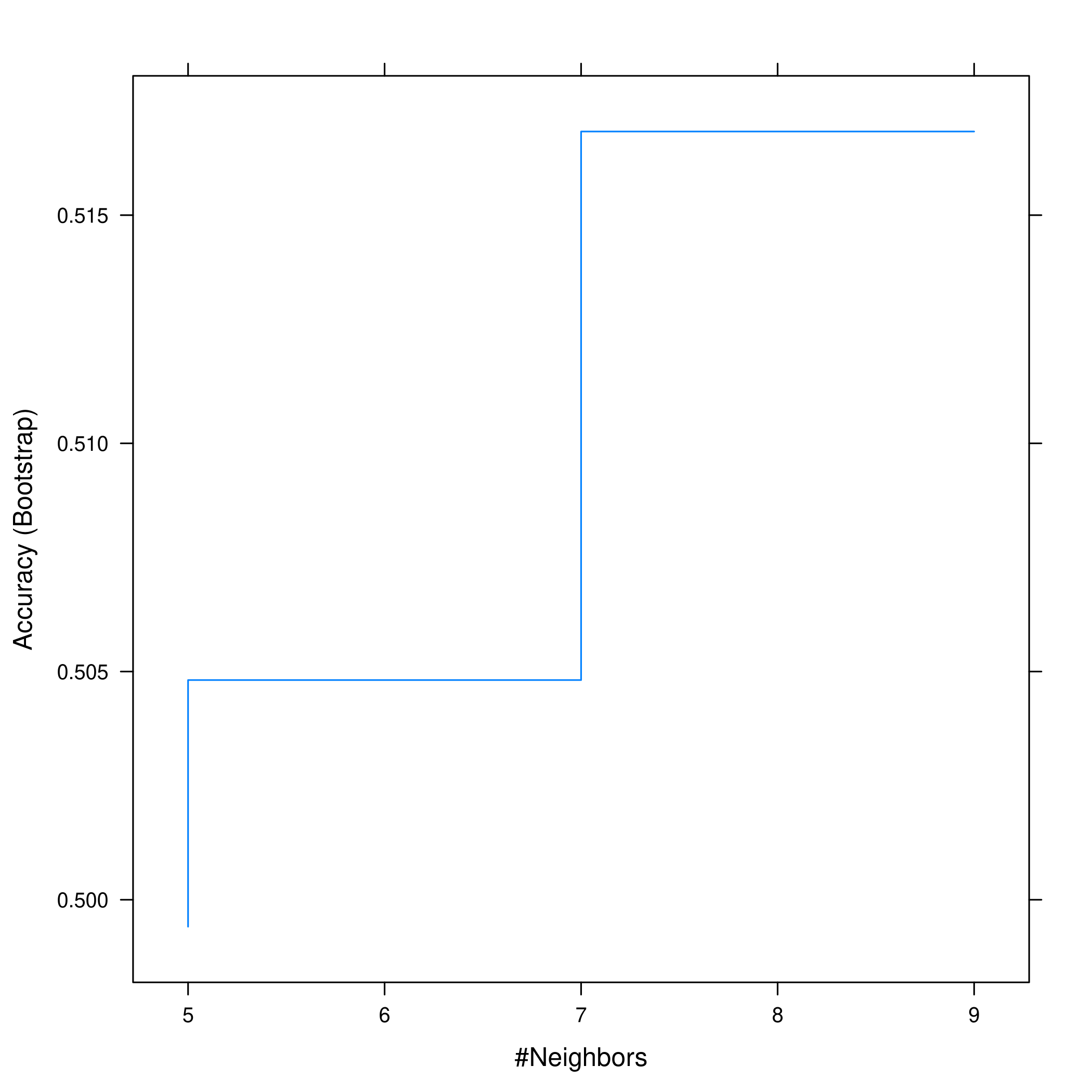

1plot(knnCaret, print.thres = 0.5, type="S")

Figure 11: Visualizing thresholds for KNN

However this shows that we don’t actually get much of an increase in accuracy anyway.

Question 4.11 - Pages 171-172

In this problem, you will develop a model to predict whether a given car gets high or low gas mileage based on the Auto data set.

(a) Create a binary variable, mpg01 , that contains a 1 if mpg

contains a value above its median, and a 0 if mpg contains a value below

its median. You can compute the median using the median() function.

Note you may find it helpful to use the data.frame() function to

create a single data set containing both mpg01 and the other Auto

variables.

(b) Explore the data graphically in order to investigate the

association between mpg01 and the other features. Which of the other

features seem most likely to be useful in predicting mpg01 ?

Scatter-plots and boxplots may be useful tools to answer this question.

Describe your findings.

(c) Split the data into a training set and a test set.

(d) Perform LDA on the training data in order to predict mpg01 using

the variables that seemed most associated with mpg01 in (b). What is

the test error of the model obtained?

(e) Perform QDA on the training data in order to predict mpg01 using

the variables that seemed most associated with mpg01 in (b). What is

the test error of the model obtained?

(f) Perform logistic regression on the training data in order to

predict mpg01 using the variables that seemed most associated with

mpg01 in (b). What is the test error of the model obtained?

(g) Perform KNN on the training data, with several values of \(K\), in

order to predict mpg01 . Use only the variables that seemed most

associated with mpg01 in (b). What test errors do you obtain? Which

value of \(K\) seems to perform the best on this data set?

Answer

1autoDat<-ISLR::Auto

a) Binary Variable

1autoDat$mpg %>% sort() %>% median()

1# [1] 22.75

Now we can get a new variable from that.

1newDat=autoDat

2newDat$mpg01 <- ifelse(autoDat$mpg<autoDat$mpg %>% sort() %>% median(),0,1) %>% factor()

Note that the ifelse command takes a truthy function, value when

false, value when true, but does not return a factor automatically so we

piped it to factor to ensure it is factorial.

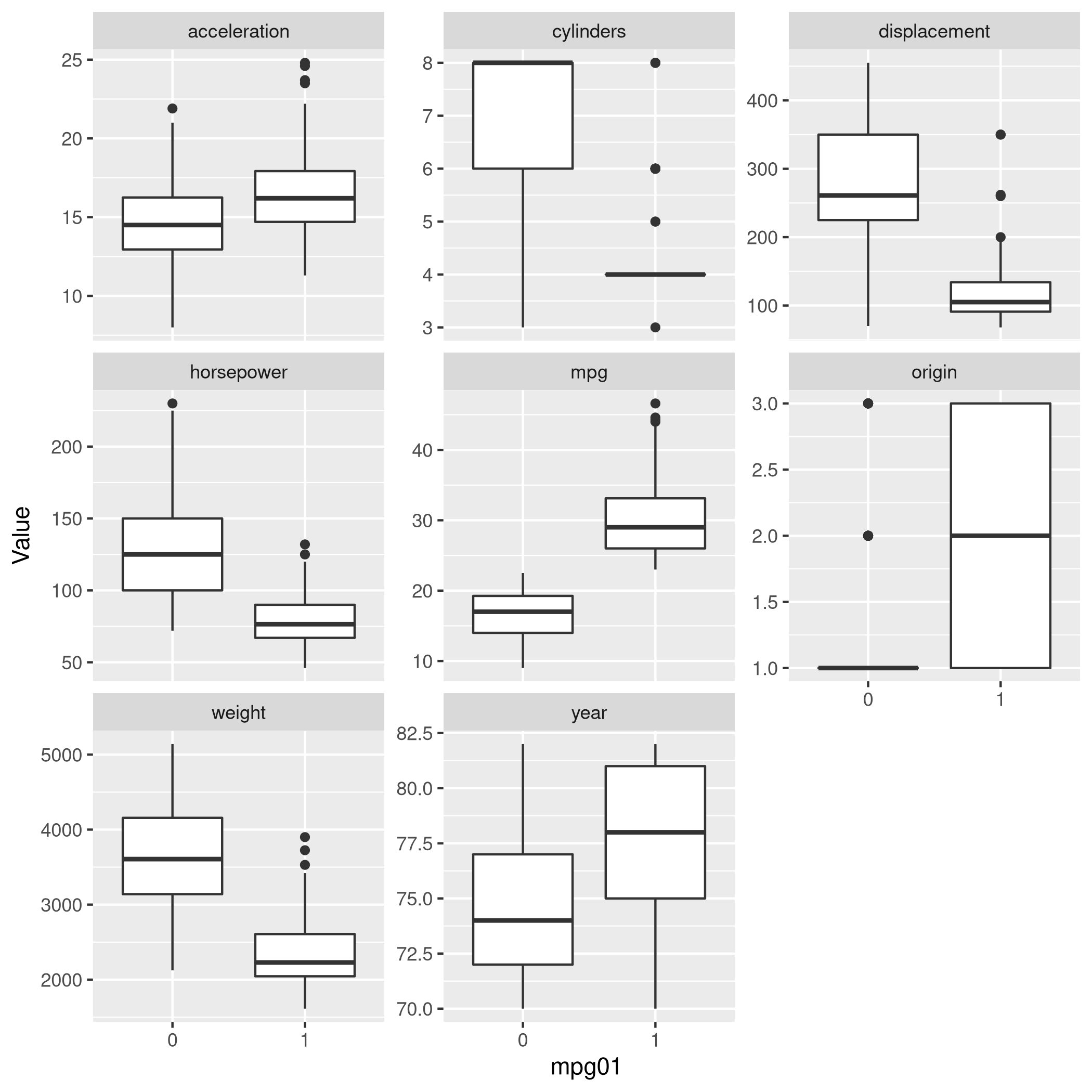

b) Visual Exploration

Some box-plots:

1newDat %>% pivot_longer(-c(mpg01,name),names_to="Params",values_to="Value") %>% ggplot(aes(x=mpg01,y=Value)) +

2 geom_boxplot() +

3 facet_wrap(~ Params, scales = "free_y")

Figure 12: Box plots

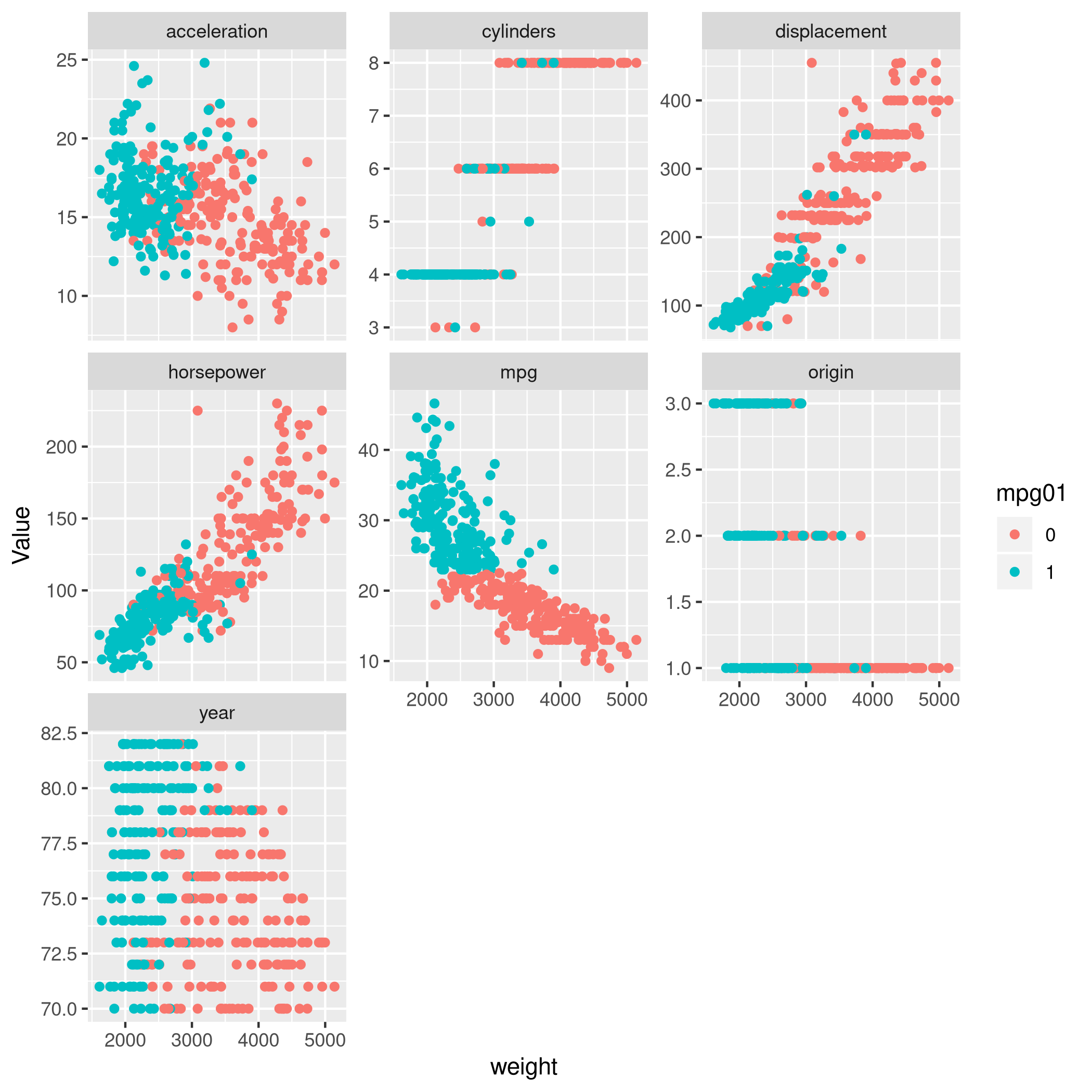

With some scatter plots as well:

1newDat %>% pivot_longer(-c(mpg01,name,weight),names_to="Params",values_to="Value") %>% ggplot(aes(x=weight,y=Value,color=mpg01)) +

2 geom_point() +

3 facet_wrap(~ Params, scales = "free_y")

Figure 13: Scatter plots

Clearly, origin, year and cylinder are essentially not very

relevant numerically for the regression lines and confidence intervals.

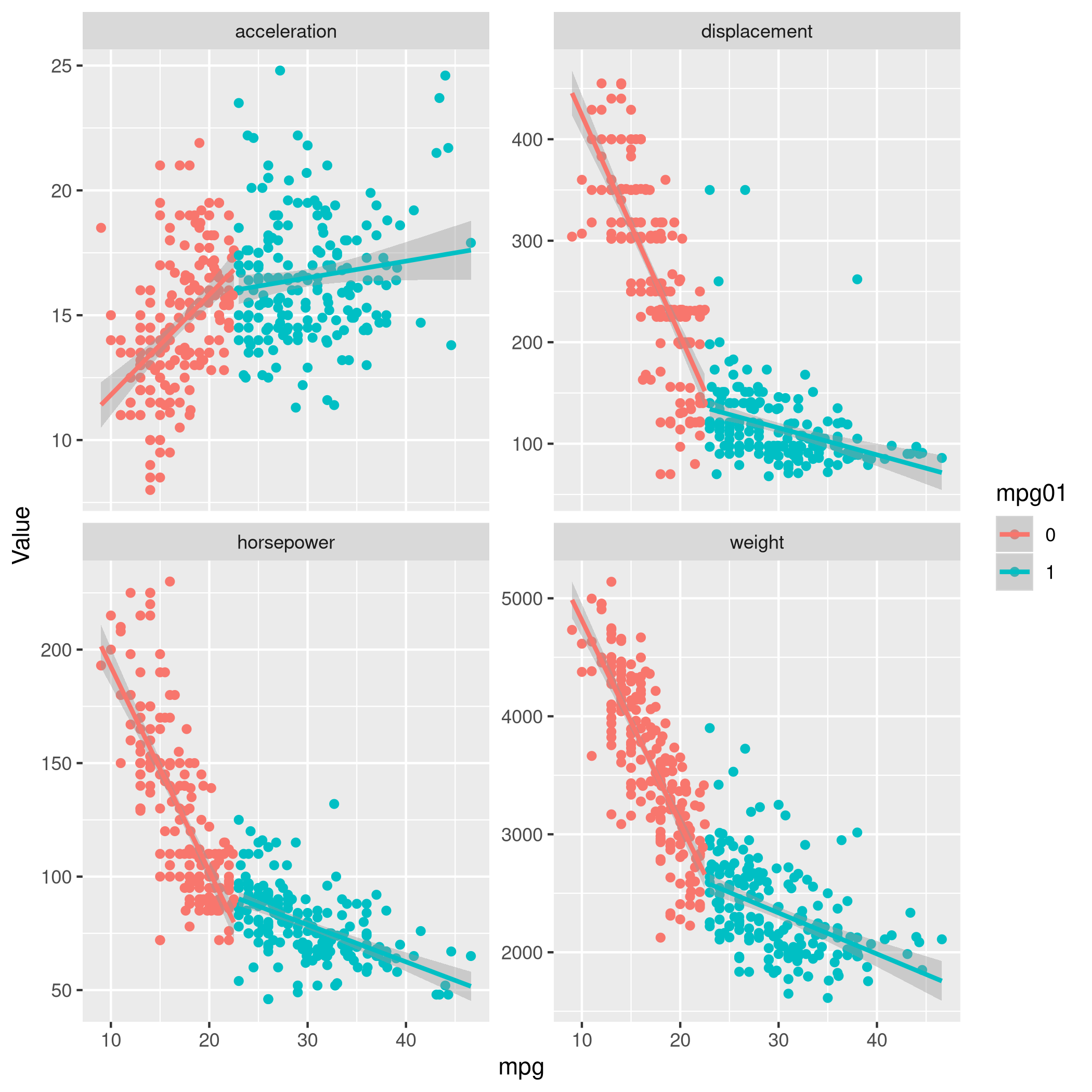

1newDat %>% select(-year,-origin,-cylinders) %>% pivot_longer(-c(mpg01,name,mpg),names_to="Params",values_to="Value") %>% ggplot(aes(x=mpg,y=Value,color=mpg01)) +

2 geom_point() +

3 geom_smooth(method=lm) +

4 facet_wrap(~ Params, scales = "free_y")

c) Train-Test Split

We can split our data

very

easily with caret. It is important to remember that for factors,

random sampling occurs within each class to preserve the overall class

distribution of the data.

1set.seed(1984)

2trainInd <- createDataPartition(newDat$mpg01, # Factor, so class sampling

3 p=0.7, # 70-30 train-test

4 list=FALSE, # No lists

5 times=1) # No bootstrap

6autoTrain<-newDat[trainInd,]

7autoTest<-newDat[-trainInd,]

d) LDA with Significant Variables

Whenever I see significant I think correlation, so let’s take a look at that.

1newDat %>% select(-mpg01,-name) %>% cor

1# mpg cylinders displacement horsepower weight

2# mpg 1.0000000 -0.7776175 -0.8051269 -0.7784268 -0.8322442

3# cylinders -0.7776175 1.0000000 0.9508233 0.8429834 0.8975273

4# displacement -0.8051269 0.9508233 1.0000000 0.8972570 0.9329944

5# horsepower -0.7784268 0.8429834 0.8972570 1.0000000 0.8645377

6# weight -0.8322442 0.8975273 0.9329944 0.8645377 1.0000000

7# acceleration 0.4233285 -0.5046834 -0.5438005 -0.6891955 -0.4168392

8# year 0.5805410 -0.3456474 -0.3698552 -0.4163615 -0.3091199

9# origin 0.5652088 -0.5689316 -0.6145351 -0.4551715 -0.5850054

10# acceleration year origin

11# mpg 0.4233285 0.5805410 0.5652088

12# cylinders -0.5046834 -0.3456474 -0.5689316

13# displacement -0.5438005 -0.3698552 -0.6145351

14# horsepower -0.6891955 -0.4163615 -0.4551715

15# weight -0.4168392 -0.3091199 -0.5850054

16# acceleration 1.0000000 0.2903161 0.2127458

17# year 0.2903161 1.0000000 0.1815277

18# origin 0.2127458 0.1815277 1.0000000

1newDat %>% length

1# [1] 10

Now lets quickly see what it looks like with correlated values removed.

1corrCols2=newDat %>% select(-mpg01,-name) %>% cor %>% findCorrelation(cutoff=0.85)

2newRed<-newDat[-c(corrCols2)]

3newRed %>% summary

1# mpg weight acceleration year origin

2# Min. : 9.00 Min. :1613 Min. : 8.00 Min. :70.00 Min. :1.000

3# 1st Qu.:17.00 1st Qu.:2225 1st Qu.:13.78 1st Qu.:73.00 1st Qu.:1.000

4# Median :22.75 Median :2804 Median :15.50 Median :76.00 Median :1.000

5# Mean :23.45 Mean :2978 Mean :15.54 Mean :75.98 Mean :1.577

6# 3rd Qu.:29.00 3rd Qu.:3615 3rd Qu.:17.02 3rd Qu.:79.00 3rd Qu.:2.000

7# Max. :46.60 Max. :5140 Max. :24.80 Max. :82.00 Max. :3.000

8#

9# name mpg01

10# amc matador : 5 0:196

11# ford pinto : 5 1:196

12# toyota corolla : 5

13# amc gremlin : 4

14# amc hornet : 4

15# chevrolet chevette: 4

16# (Other) :365

Inherent in this discussion is the fact that I consider what is

correlated to mpg to be a good indicator of what will help mpg01 for

obvious reasons.

Now we can just use the columns we found with findCorrelation.

1corrCols2 %>% print

1# [1] 3 4 2

1names(newDat)

1# [1] "mpg" "cylinders" "displacement" "horsepower" "weight"

2# [6] "acceleration" "year" "origin" "name" "mpg01"

1autoLDA=train(mpg01~cylinders+displacement+horsepower,data=autoTrain,method="lda")

2valScoreLDA=predict(autoLDA,autoTest)

Now we can check the statistics.

1confusionMatrix(valScoreLDA,autoTest$mpg01)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 56 2

6# 1 2 56

7#

8# Accuracy : 0.9655

9# 95% CI : (0.9141, 0.9905)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.931

14#

15# Mcnemar's Test P-Value : 1

16#

17# Sensitivity : 0.9655

18# Specificity : 0.9655

19# Pos Pred Value : 0.9655

20# Neg Pred Value : 0.9655

21# Prevalence : 0.5000

22# Detection Rate : 0.4828

23# Detection Prevalence : 0.5000

24# Balanced Accuracy : 0.9655

25#

26# 'Positive' Class : 0

27#

That is an amazingly accurate model.

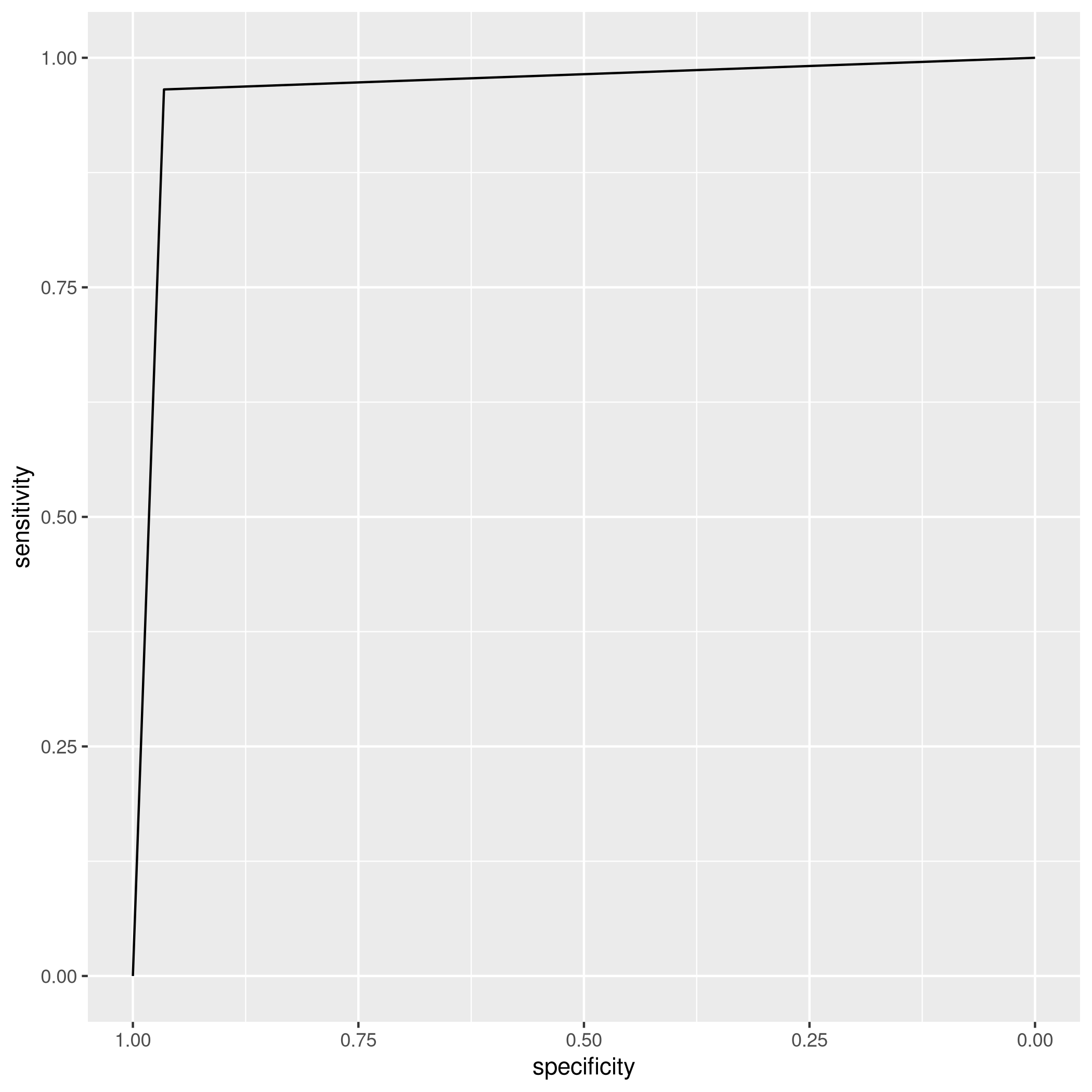

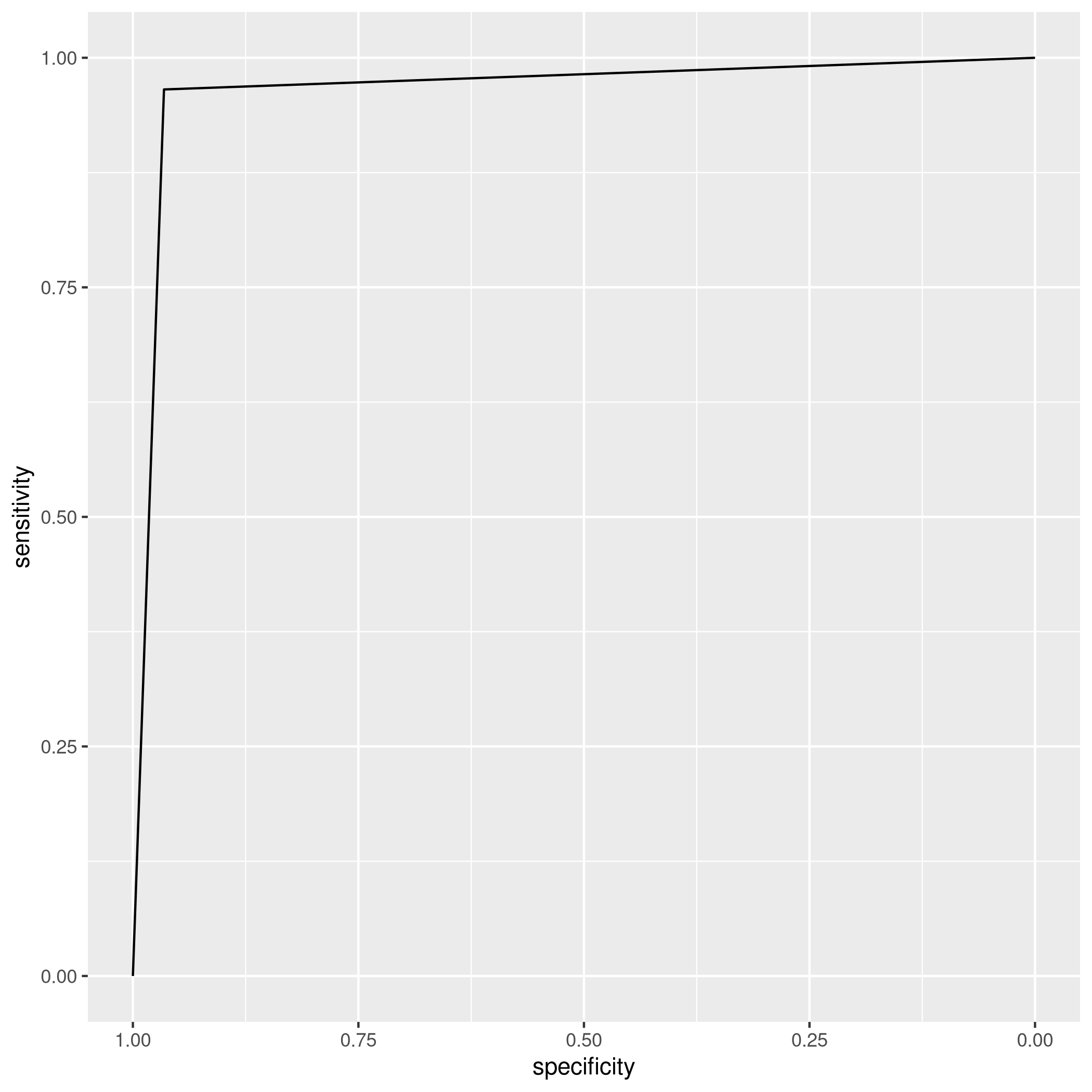

1auto_ldaROC<-roc(predictor=as.numeric(valScoreLDA),response=autoTest$mpg01,levels=levels(autoTest$mpg01))

1# Setting direction: controls < cases

1ggroc(auto_ldaROC)

e) QDA with Significant Variables

Same deal as before.

1autoQDA=train(mpg01~cylinders+displacement+horsepower,data=autoTrain,method="qda")

2valScoreQDA=predict(autoQDA,autoTest)

Now we can check the statistics.

1confusionMatrix(valScoreQDA,autoTest$mpg01)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 56 2

6# 1 2 56

7#

8# Accuracy : 0.9655

9# 95% CI : (0.9141, 0.9905)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.931

14#

15# Mcnemar's Test P-Value : 1

16#

17# Sensitivity : 0.9655

18# Specificity : 0.9655

19# Pos Pred Value : 0.9655

20# Neg Pred Value : 0.9655

21# Prevalence : 0.5000

22# Detection Rate : 0.4828

23# Detection Prevalence : 0.5000

24# Balanced Accuracy : 0.9655

25#

26# 'Positive' Class : 0

27#

1auto_qdaROC<-roc(predictor=as.numeric(valScoreQDA),response=autoTest$mpg01,levels=levels(autoTest$mpg01))

1# Setting direction: controls < cases

1ggroc(auto_qdaROC)

OK, this is weird enough to check if it isn’t some sort of artifact.

1autoQDA2=train(mpg01~horsepower, data=autoTrain,method='qda')

2valScoreQDA2=predict(autoQDA2, autoTest)

3confusionMatrix(valScoreQDA2,autoTest$mpg01)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 42 3

6# 1 16 55

7#

8# Accuracy : 0.8362

9# 95% CI : (0.7561, 0.8984)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : 4.315e-14

12#

13# Kappa : 0.6724

14#

15# Mcnemar's Test P-Value : 0.005905

16#

17# Sensitivity : 0.7241

18# Specificity : 0.9483

19# Pos Pred Value : 0.9333

20# Neg Pred Value : 0.7746

21# Prevalence : 0.5000

22# Detection Rate : 0.3621

23# Detection Prevalence : 0.3879

24# Balanced Accuracy : 0.8362

25#

26# 'Positive' Class : 0

27#

OK, so the model isn’t completely creepily correct all the time. In this

case we should probably think about what is going on. I would think it

is because of the nature of the train-test split we performed. We have

ensured during the sampling of our data that the train and test sets

contain the SAME distribution (assumed). So that’s why our training

result and test results are both incredibly good. They’re essentially

the same thing.

In fact, this is the perfect time to consider a validation set, just to see what the models are really doing. Won’t get into it right now though.

f) Logistic with Significant Variables

1glmAuto.fit=glm(mpg01~cylinders+displacement+horsepower, data=autoTrain, family=binomial)

1glmAuto.probs = predict(glmAuto.fit,autoTest, type = "response")

2glmAuto.pred = rep(1,length(glmAuto.probs))

3glmAuto.pred[glmAuto.probs<0.5]=0

4glmAuto.pred=factor(glmAuto.pred)

5confusionMatrix(glmAuto.pred,autoTest$mpg01)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 56 4

6# 1 2 54

7#

8# Accuracy : 0.9483

9# 95% CI : (0.8908, 0.9808)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.8966

14#

15# Mcnemar's Test P-Value : 0.6831

16#

17# Sensitivity : 0.9655

18# Specificity : 0.9310

19# Pos Pred Value : 0.9333

20# Neg Pred Value : 0.9643

21# Prevalence : 0.5000

22# Detection Rate : 0.4828

23# Detection Prevalence : 0.5172

24# Balanced Accuracy : 0.9483

25#

26# 'Positive' Class : 0

27#

g) KNN Modeling

Scale the parameters later.

1knnAuto=train(mpg01~cylinders+displacement+horsepower,data=autoTrain,method="knn")

Plot KNN with the best parameters.

1plot(knnCaret)

Evidently, the accuracy increases with an increase in the number of neighbors considered.

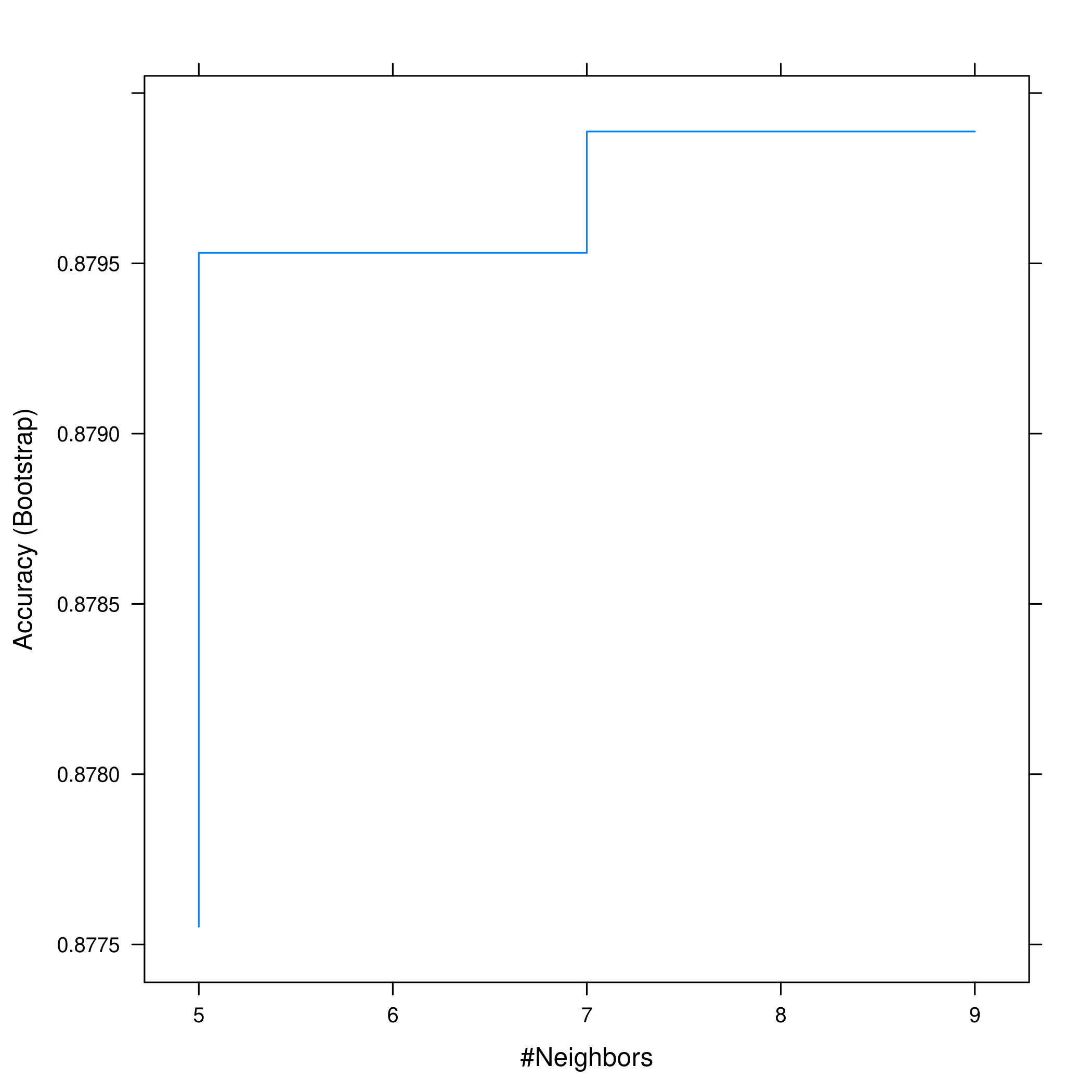

1plot(knnAuto, print.thres = 0.5, type="S")

So we can see that \(5\) neighbors is a good compromise.

Question 4.12 - Pages 172-173

This problem involves writing functions.

(a) Write a function, Power() , that prints out the result of

raising 2 to the 3rd power. In other words, your function should compute

2^3 and print out the results.

Hint: Recall that x^a raises x to the power a. Use the print()

function to output the result.

(b) Create a new function, Power2() , that allows you to pass any

two numbers, x and a , and prints out the value of x^a . You can

do this by beginning your function with the line

1Power2=function(x,a){}

You should be able to call your function by entering, for instance,

1Power2(3,8)

on the command line. This should output the value of \(3^8\), namely, \(6,651\).

(c) Using the Power2() function that you just wrote, compute \(10^3\),

\(8^{17}\), and \(131^3\).

(d) Now create a new function, Power3(), that actually returns the

result x^a as an R object, rather than simply printing it to the

screen. That is, if you store the value x^a in an object called

result within your function, then you can simply return() this

result, using the following line:

1return(result)

The line above should be the last line in your function, before the }

symbol.

(e) Now using the Power3() function, create a plot of \(f(x)=x^2\).

The x-axis should display a range of integers from \(1\) to \(10\), and

the y-axis should display \(x^2\) . Label the axes appropriately, and

use an appropriate title for the figure. Consider displaying either the

x-axis, the y-axis, or both on the log-scale. You can do this by

using log=‘‘x’’, log=‘‘y’’, or log=‘‘xy’’ as arguments to the

plot() function.

(f) Create a function, PlotPower() , that allows you to create a

plot of x against x^a for a fixed a and for a range of values of

x. For instance, if you call

1PlotPower (1:10 ,3)

then a plot should be created with an x-axis taking on values \(1,2,…,10\) and a y-axis taking on values \(1^3,2^3,…,10^3\)

Answer

a) Create a Squaring Function

1Power=function(x){print(2^x)}

2Power(3)

1# [1] 8

b) Generalizing Power to arbitrary numbers

1Power2=function(x,a){print(x^a)}

1Power2(3,8)

1# [1] 6561

c) Random Testing of Power2

1Power2(10,3)

1# [1] 1000

1Power2(8,17)

1# [1] 2.2518e+15

1Power2(131,2)

1# [1] 17161

d) Return a value

1Power3=function(x,a){return(x^a)}

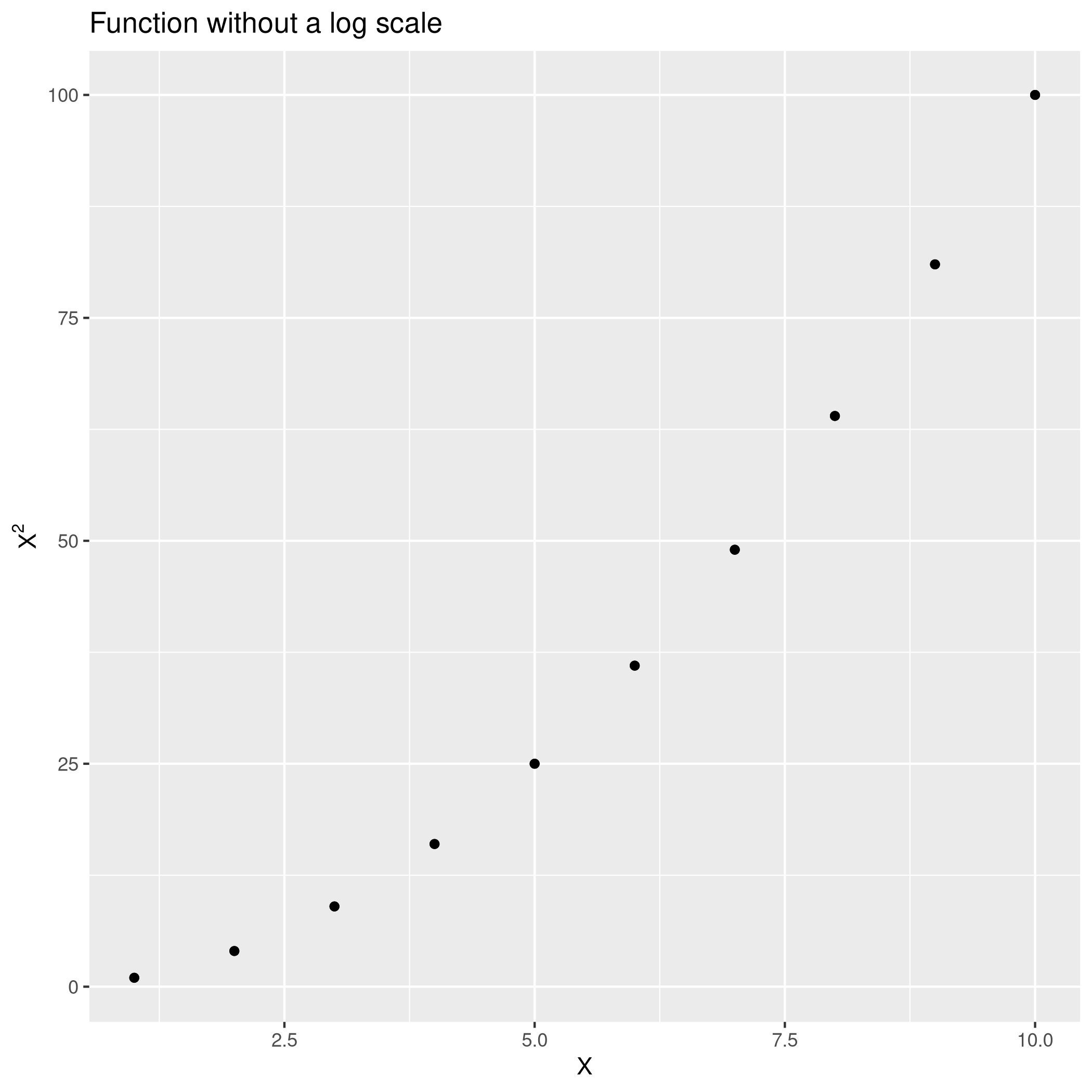

e) Plot something with Power3

Actually now would be a good place to introduce LaTeX labeling.

1#install.packages("latex2exp")

2library(latex2exp)

No log scale.

1qplot(x=seq(1,10),y=Power3(seq(1,10),2)) + ggtitle("Function without a log scale") +

2 geom_point() + xlab("X") + ylab(TeX("$X^2$"))

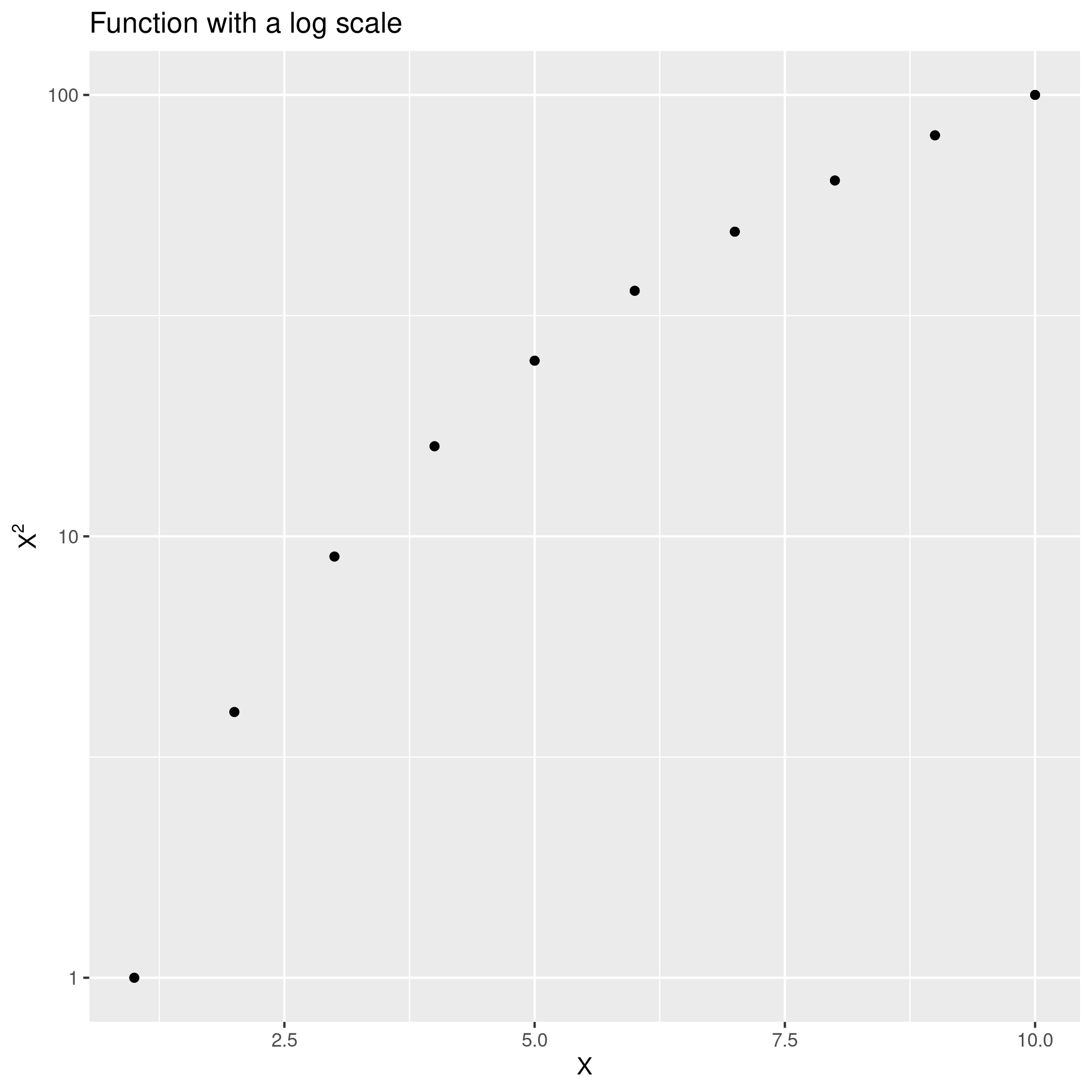

With a log scale.

1qplot(x=seq(1,10),y=Power3(seq(1,10),2)) + ggtitle("Function with a log scale") +

2 geom_point() + xlab("X") + ylab(TeX("$X^2$")) + scale_y_log10()

f) PlotPower Function

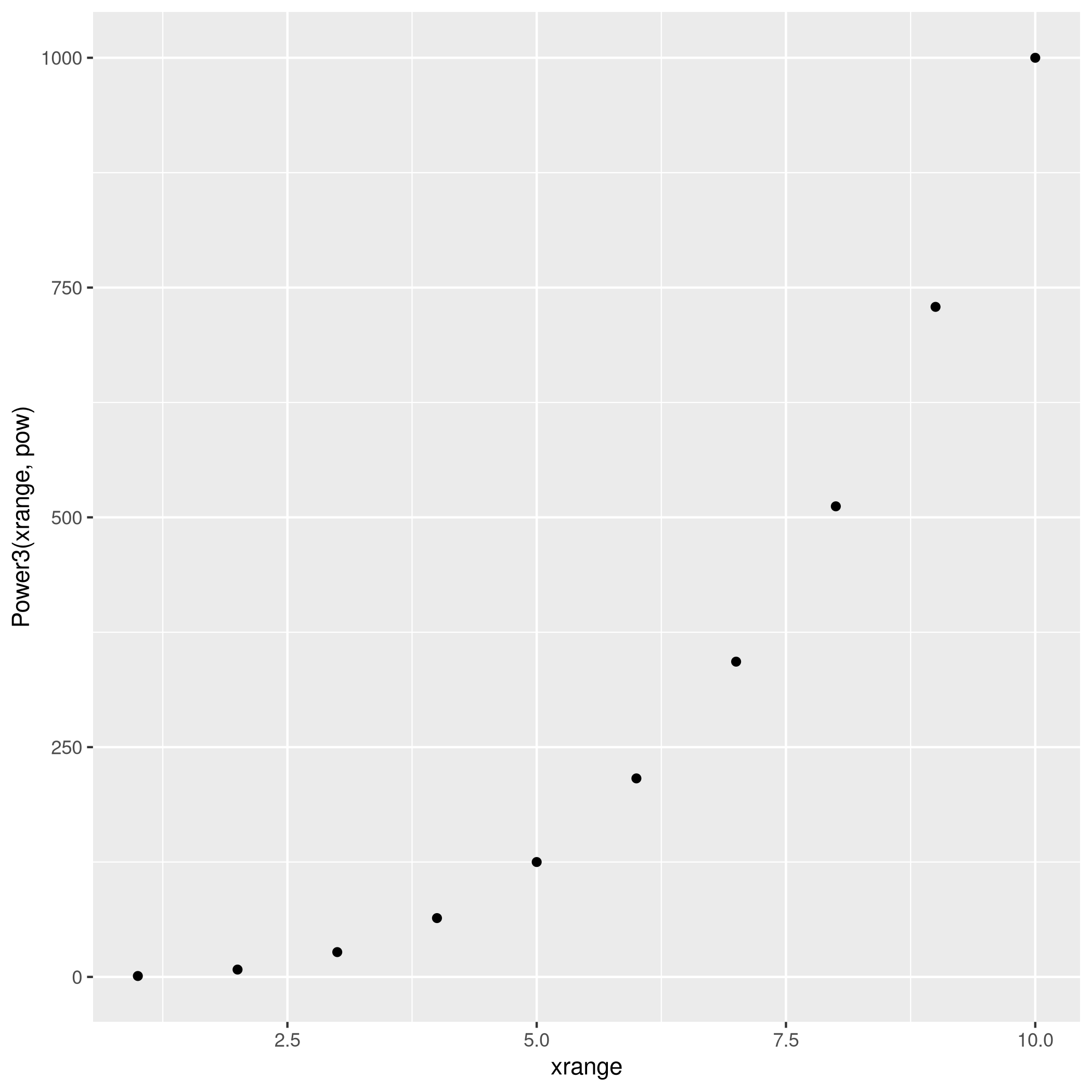

1PlotPower=function(xrange,pow){return(qplot(x=xrange,y=Power3(xrange,pow)))}

1plotter<-PlotPower(1:10,3)

2plotter

The R Cookbook is quite neat for some simple tasks like this.

Question 4.13 - Pages 173

Using the Boston data set, fit classification models in order to

predict whether a given suburb has a crime rate above or below the

median. Explore logistic regression, LDA, and KNN models using various

subsets of the predictors. Describe your findings.

Answer

OK, to speed this up, I will simply run through all the work done on the

Auto set. Recall that details about this data-set are

also

here.

1boston<-MASS::Boston

- Check unique values

1boston %>% sapply(unique) %>% sapply(length)

1# crim zn indus chas nox rm age dis rad tax

2# 504 26 76 2 81 446 356 412 9 66

3# ptratio black lstat medv

4# 46 357 455 229

CHAS is of course something which should be a factor, and with RAD

having only \(9\) levels, I’m inclined to make it a factor as well.

1boston<-boston %>% mutate(rad=factor(rad),chas=factor(chas))

- Make a median variable

1boston$highCrime<- ifelse(boston$crim<boston$crim %>% median(),0,1) %>% factor()

- Take a look at the data

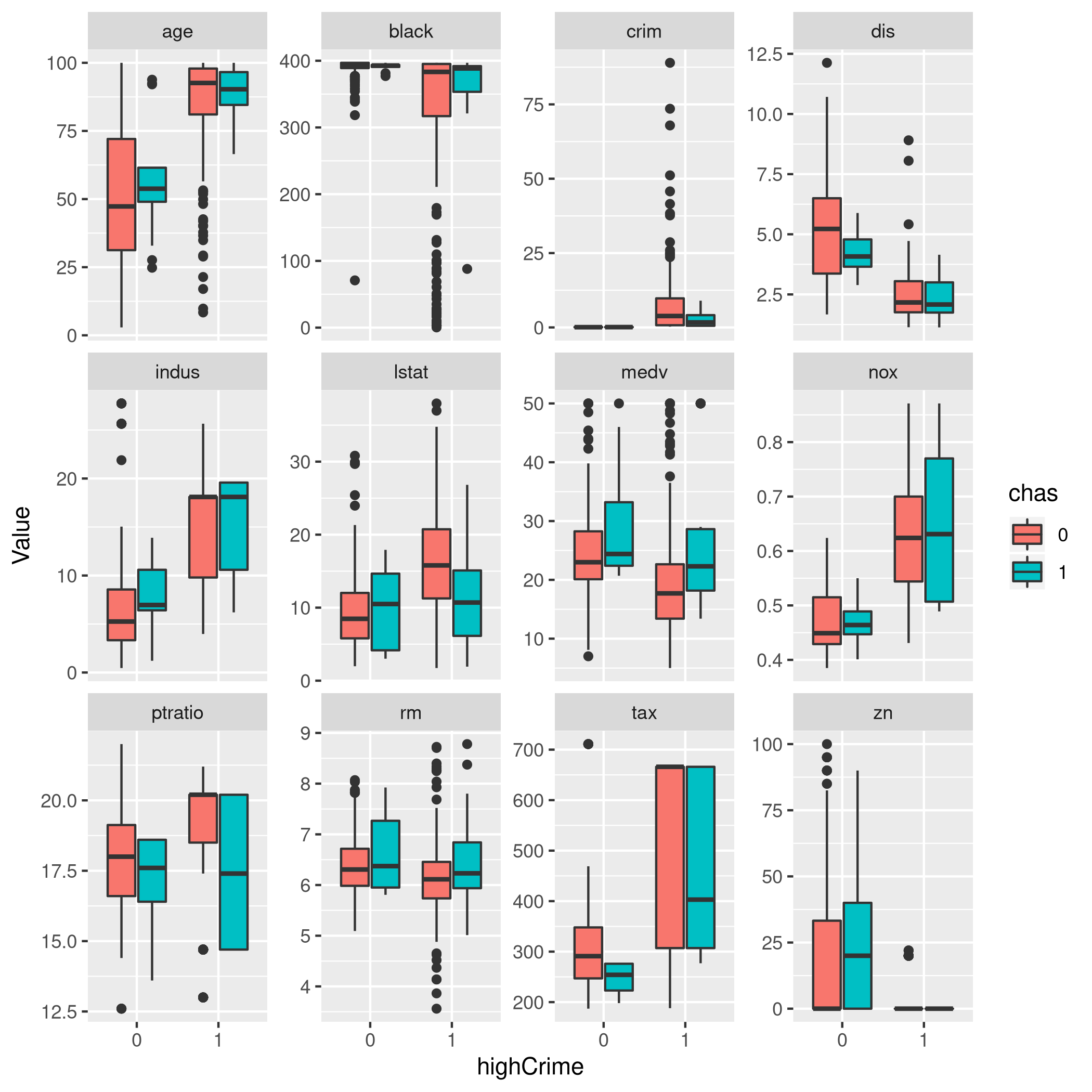

Some box-plots:

1boston %>% pivot_longer(-c(rad,chas,highCrime),names_to="Param",values_to="Value") %>% ggplot(aes(x=highCrime,y=Value,fill=chas)) +

2 geom_boxplot()+

3 facet_wrap(~Param,scales="free_y")

It is surprising, but evidently the CHAS variable is strangely

relevant. 1 implies the tract bounds the river, otherwise 0.

- Correlations

1boston %>% select(-c(rad,chas,highCrime)) %>% cor

1# crim zn indus nox rm age

2# crim 1.0000000 -0.2004692 0.4065834 0.4209717 -0.2192467 0.3527343

3# zn -0.2004692 1.0000000 -0.5338282 -0.5166037 0.3119906 -0.5695373

4# indus 0.4065834 -0.5338282 1.0000000 0.7636514 -0.3916759 0.6447785

5# nox 0.4209717 -0.5166037 0.7636514 1.0000000 -0.3021882 0.7314701

6# rm -0.2192467 0.3119906 -0.3916759 -0.3021882 1.0000000 -0.2402649

7# age 0.3527343 -0.5695373 0.6447785 0.7314701 -0.2402649 1.0000000

8# dis -0.3796701 0.6644082 -0.7080270 -0.7692301 0.2052462 -0.7478805

9# tax 0.5827643 -0.3145633 0.7207602 0.6680232 -0.2920478 0.5064556

10# ptratio 0.2899456 -0.3916785 0.3832476 0.1889327 -0.3555015 0.2615150

11# black -0.3850639 0.1755203 -0.3569765 -0.3800506 0.1280686 -0.2735340

12# lstat 0.4556215 -0.4129946 0.6037997 0.5908789 -0.6138083 0.6023385

13# medv -0.3883046 0.3604453 -0.4837252 -0.4273208 0.6953599 -0.3769546

14# dis tax ptratio black lstat medv

15# crim -0.3796701 0.5827643 0.2899456 -0.3850639 0.4556215 -0.3883046

16# zn 0.6644082 -0.3145633 -0.3916785 0.1755203 -0.4129946 0.3604453

17# indus -0.7080270 0.7207602 0.3832476 -0.3569765 0.6037997 -0.4837252

18# nox -0.7692301 0.6680232 0.1889327 -0.3800506 0.5908789 -0.4273208

19# rm 0.2052462 -0.2920478 -0.3555015 0.1280686 -0.6138083 0.6953599

20# age -0.7478805 0.5064556 0.2615150 -0.2735340 0.6023385 -0.3769546

21# dis 1.0000000 -0.5344316 -0.2324705 0.2915117 -0.4969958 0.2499287

22# tax -0.5344316 1.0000000 0.4608530 -0.4418080 0.5439934 -0.4685359

23# ptratio -0.2324705 0.4608530 1.0000000 -0.1773833 0.3740443 -0.5077867

24# black 0.2915117 -0.4418080 -0.1773833 1.0000000 -0.3660869 0.3334608

25# lstat -0.4969958 0.5439934 0.3740443 -0.3660869 1.0000000 -0.7376627

26# medv 0.2499287 -0.4685359 -0.5077867 0.3334608 -0.7376627 1.0000000

Now, unsurprisingly, there’s nothing which is really strongly correlated here for some reason.

- Train test splits

1set.seed(1984)

2trainIndCri <- createDataPartition(boston$highCrime, # Factor, so class sampling

3 p=0.7, # 70-30 train-test

4 list=FALSE, # No lists

5 times=1) # No bootstrap

6bostonTrain<-boston[trainIndCri,]

7bostonTest<-boston[-trainIndCri,]

- Make a bunch of models

1glmBos.fit=glm(highCrime~., data=bostonTrain, family=binomial)

1# Warning: glm.fit: algorithm did not converge

1# Warning: glm.fit: fitted probabilities numerically 0 or 1 occurred

1glmBos.probs = predict(glmBos.fit,bostonTest, type = "response")

2glmBos.pred = rep(1,length(glmBos.probs))

3glmBos.pred[glmBos.probs<0.5]=0

4glmBos.pred=factor(glmBos.pred)

5confusionMatrix(glmBos.pred,bostonTest$highCrime)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 68 6

6# 1 7 69

7#

8# Accuracy : 0.9133

9# 95% CI : (0.8564, 0.953)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.8267

14#

15# Mcnemar's Test P-Value : 1

16#

17# Sensitivity : 0.9067

18# Specificity : 0.9200

19# Pos Pred Value : 0.9189

20# Neg Pred Value : 0.9079

21# Prevalence : 0.5000

22# Detection Rate : 0.4533

23# Detection Prevalence : 0.4933

24# Balanced Accuracy : 0.9133

25#

26# 'Positive' Class : 0

27#

1bostonLDA=train(highCrime~.,data=bostonTrain,method='lda')

2bostonQDA=train(highCrime~tax+crim,data=bostonTrain,method='qda')

3bostonKNN=train(highCrime~.,data=bostonTrain,preProcess = c("center","scale"),method='knn')

1bLDAp=predict(bostonLDA,bostonTest)

2bQDAp=predict(bostonQDA,bostonTest)

3bKNNp=predict(bostonKNN,bostonTest)

1confusionMatrix(bLDAp,bostonTest$highCrime)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 72 6

6# 1 3 69

7#

8# Accuracy : 0.94

9# 95% CI : (0.8892, 0.9722)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.88

14#

15# Mcnemar's Test P-Value : 0.505

16#

17# Sensitivity : 0.9600

18# Specificity : 0.9200

19# Pos Pred Value : 0.9231

20# Neg Pred Value : 0.9583

21# Prevalence : 0.5000

22# Detection Rate : 0.4800

23# Detection Prevalence : 0.5200

24# Balanced Accuracy : 0.9400

25#

26# 'Positive' Class : 0

27#

1confusionMatrix(bQDAp,bostonTest$highCrime)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 73 5

6# 1 2 70

7#

8# Accuracy : 0.9533

9# 95% CI : (0.9062, 0.981)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.9067

14#

15# Mcnemar's Test P-Value : 0.4497

16#

17# Sensitivity : 0.9733

18# Specificity : 0.9333

19# Pos Pred Value : 0.9359

20# Neg Pred Value : 0.9722

21# Prevalence : 0.5000

22# Detection Rate : 0.4867

23# Detection Prevalence : 0.5200

24# Balanced Accuracy : 0.9533

25#

26# 'Positive' Class : 0

27#

1confusionMatrix(bKNNp,bostonTest$highCrime)

1# Confusion Matrix and Statistics

2#

3# Reference

4# Prediction 0 1

5# 0 74 6

6# 1 1 69

7#

8# Accuracy : 0.9533

9# 95% CI : (0.9062, 0.981)

10# No Information Rate : 0.5

11# P-Value [Acc > NIR] : <2e-16

12#

13# Kappa : 0.9067

14#

15# Mcnemar's Test P-Value : 0.1306

16#

17# Sensitivity : 0.9867

18# Specificity : 0.9200

19# Pos Pred Value : 0.9250

20# Neg Pred Value : 0.9857

21# Prevalence : 0.5000

22# Detection Rate : 0.4933

23# Detection Prevalence : 0.5333

24# Balanced Accuracy : 0.9533

25#

26# 'Positive' Class : 0

27#

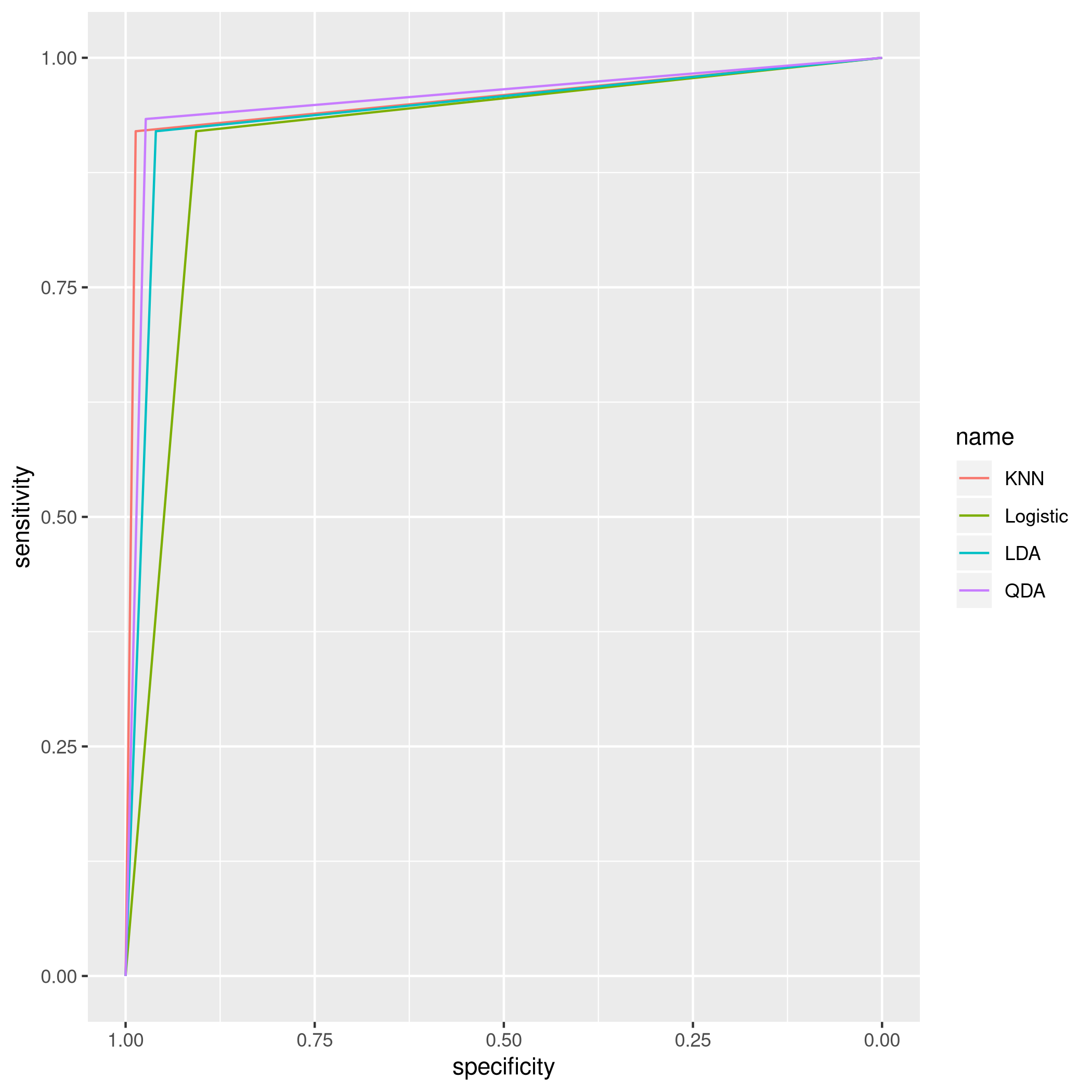

Clearly in this particular case, an LDA model seems to be working out the best for this data when trained on all the parameters, though Logistic Regression is doing quite well too.

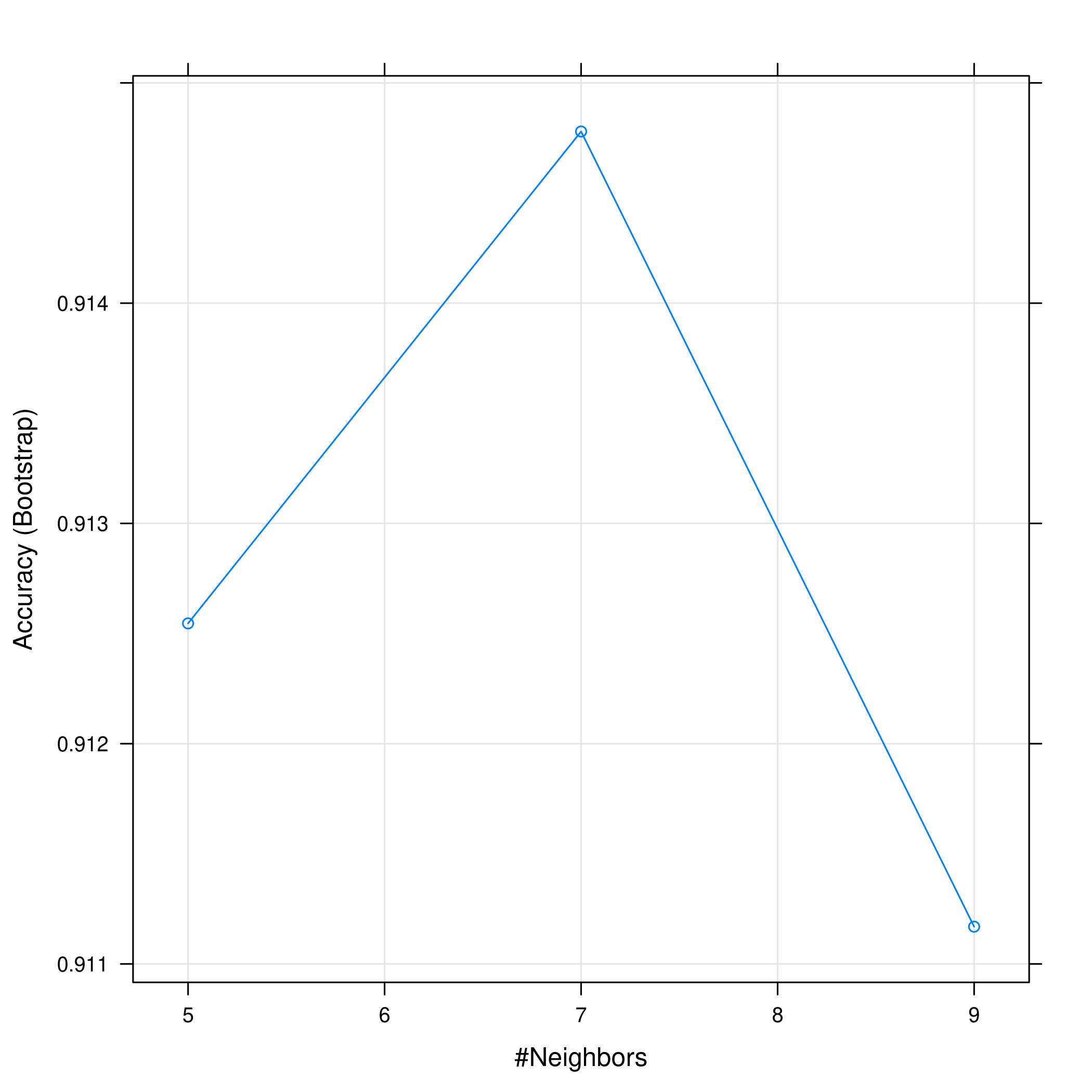

- Notes on KNN

1plot(bostonKNN)

1plot(bostonKNN, print.thres = 0.5, type="S")

- Comparison

Finally, we will quickly plot some indicative measures.

1knnBosROC<-roc(predictor=as.numeric(bKNNp),response=bostonTest$highCrime)

1# Setting levels: control = 0, case = 1

1# Setting direction: controls < cases

1logiBosROC<-roc(predictor=as.numeric(glmBos.probs),response=bostonTest$highCrime)

1# Setting levels: control = 0, case = 1

2# Setting direction: controls < cases

1ldaBosROC<-roc(predictor=as.numeric(bLDAp),response=bostonTest$highCrime)

1# Setting levels: control = 0, case = 1

2# Setting direction: controls < cases

1qdaBosROC<-roc(predictor=as.numeric(bQDAp),response=bostonTest$highCrime)

1# Setting levels: control = 0, case = 1

2# Setting direction: controls < cases

1ggroc(list(KNN=knnBosROC,Logistic=logiBosROC,LDA=ldaBosROC,QDA=qdaBosROC))

Figure 14: plot of chunk unnamed-chunk-87

OK, one of the reasons why these models do so well is because they are

all assuming an equal distribution of train and test classes, and they

use crim itself as a predictor. This is no doubt a strong reason why

these models uniformly perform so well. I’d say 5 is the best option.